Jo Jagadish, who joined TD Bank in April as head of commercial products and payments innovation, spent her childhood moving from country to country, so she's used to a world without borders — the kind of world emerging from the capabilities of fintech and demands of the pandemic.

The Internal Revenue Service is giving parents another chance to list their kids so they can receive an extra $500 per child in economic impact payments under the CARES Act.

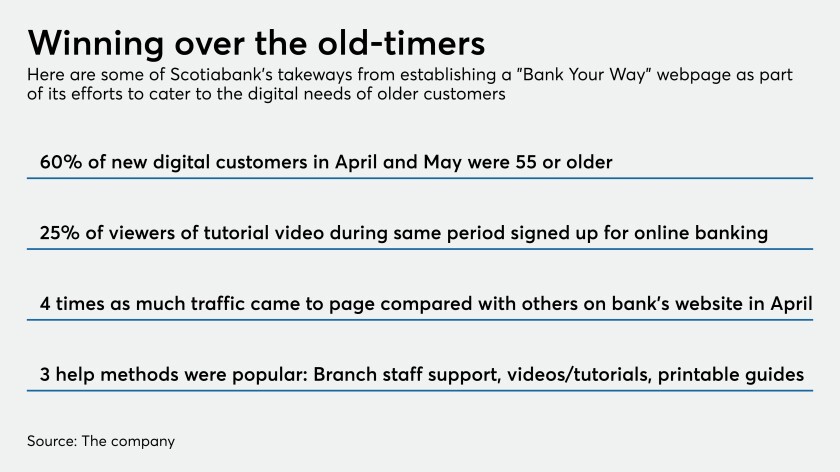

The Canadian bank is doing something few U.S. institutions have done: build an online hub with tutorials designed expressly to simplify the online banking process for newcomers.

There’s little chance of agreement on a new federal coronavirus relief plan without a compromise on the roughly $1 trillion in aid to beleaguered state and local governments that Democrats demand and the White House opposes.

White House officials said the administration has no plans to do away with the payroll tax despite President Donald Trump saying he would seek a permanent repeal if he wins another term.

The U.S. Small Business Administration has posted rules about how businesses who have been turned down for forgiveness of their Paycheck Protection Program loans can appeal the decision.

The American Institute of CPAs has sent a letter to top officials asking for more guidance on the president's executive order.

Firms of all sizes should be prepared to respond appropriately and help their clients protect the health and safety of their workforce by complying with ever-changing guidelines from federal, state and local authorities.

Payroll companies need guidelines on how to implement President Trump's executive order before they can start processing paychecks next month.

The White House isn’t considering an executive order to carry out President Donald Trump’s call for a cut in the capital gains tax because Congress probably would have to change the rate, administration officials said.