Among the pandemic-related issues covered are how to handle the Paycheck Protection Program and other stimulus efforts.

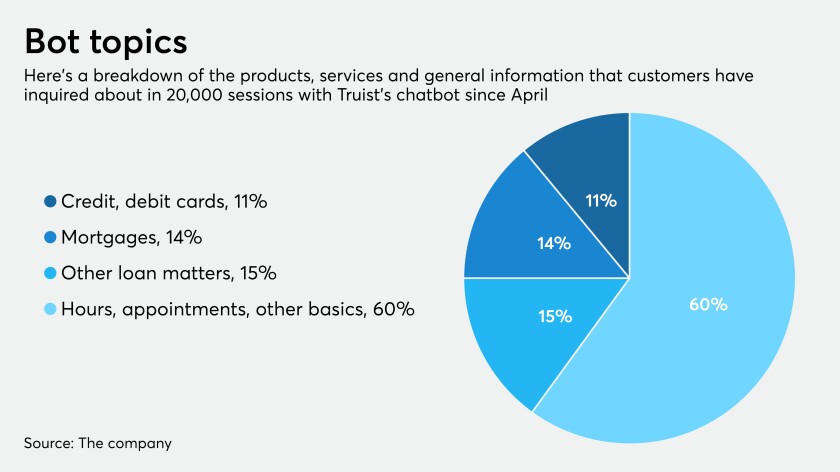

Built to respond to borrowers' questions about mortgage deferrals, the bot created by Salesforce is evolving and in the future could conduct transactions, handle a wide range of queries or help with emergencies.

A public-private partnership that has fewer rules and restrictions than the Paycheck Protection Program would save more small businesses.

President Donald Trump’s order to delay collection of payroll taxes thrusts a dilemma on U.S. companies: continue withholding the money from workers expecting bigger paychecks or pass it on and potentially put themselves or their employees at risk of a big end-of-year bill from the IRS.

President Donald Trump is tapping his presidential authority to make tax changes that Congress is refusing to do, but his limited power means he could end up over-promising and under-delivering on his pledge to slash IRS bills.

Outsourced accounting is among the options business leaders should carefully consider in these unprecedented times.

President Donald Trump said he’s “very seriously” considering a capital gains tax cut, a move he decided against last September after saying it wouldn’t do enough to help the middle class.

PricewaterhouseCoopers has been building its managed tax services business since 2017, but now it sees an opportunity to help companies who are dealing with COVID-19.

More than a third fear the fallout from the coronavirus pandemic could drag into 2022 or later, and they are most worried about commercial real estate loans, according to a Promontory Interfinancial Network survey.

Tamera Loerzel and Jennifer Wilson of ConvergenceCoaching return to look at external issues that the coronavirus pandemic has raised for accounting firms in terms of dealing with clients, revamping services offerings and more.