Lenders need to use alternative data as an overlay to traditional underwriting methods to help creditworthy customers in hardship because of the coronavirus crisis.

The American Institute of CPAs reported Thursday that its Personal Financial Satisfaction Index declined 55 percent in the second quarter of the year, a level not seen since 2015, as the COVID-19 pandemic continued to ravage consumer finances.

CEO Greg Carmichael says the Cincinnati company has cut expenses but will proceed with branch openings in the Southeast and investments in its commercial loan and mortgage origination platforms to lay the groundwork for post-pandemic growth.

Hospitals margins could sink to unsustainable negative levels in the last half of the year, according to forecasts.

Any boost for workers from a payroll tax cut that President Donald Trump favors would take weeks to kick in and the effects could be distributed unevenly.

Republicans and the White House are counting on Senate Majority Leader Mitch McConnell reconciling GOP differences with a draft coronavirus relief package that they can take into negotiations with congressional Democrats.

Universities are facing the same uncertainties as any other business during the coronavirus pandemic. This is especially true for universities that cater to international students.

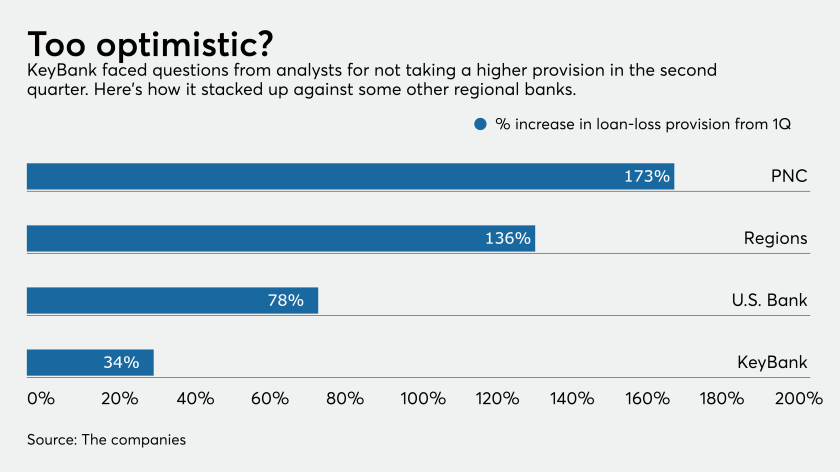

Other regionals set more aside for loan losses than the Cleveland bank did in the second quarter, and its ratio of reserves to total loans is slightly lower, too. But Key executives say the portfolio is balanced and holding up well despite the pandemic’s economic toll.

Massachusetts Society of CPAs president and CEO Amy Pitter is spearheading a group of 28 state society heads who have sent a letter to congressional leaders.

The Tax Cuts and Jobs Act created opportunity zones as an economic development tool to stimulate investments in distressed communities.