As far as the taxman is concerned, home is where the heart is.

People who aren’t required to file a U.S. tax return have less than three months to alert the Internal Revenue Service if they haven’t yet received a $1,200 stimulus payment from the government, Commissioner Chuck Rettig said.

Republicans crafting their own plan for a new U.S. virus-relief bill broadly endorsed a fresh round of stimulus checks to individuals, extended supplemental jobless benefits and more money for testing while voicing doubts over President Donald Trump’s desired payroll tax cut.

IRS Commissioner Chuck Rettig expressed his appreciation to tax professionals Tuesday for their cooperation during the extended tax season that was prolonged by the novel coronavirus pandemic and pledged to deliver any future stimulus payments approved by Congress.

The Dallas bank set aside less in the second quarter for credit losses than analysts expected. Executives cited action in Texas and California to reverse reopenings and said they're still committed to the oil and gas business.

The Federal Reserve, U.S. Mint and financial industry representatives are strongly considering a public call for Americans to deposit their spare change, among other fixes, to get coins circulating again. Meanwhile, banks of all sizes are getting creative at the local level.

The International Federation of Accountants called on national leaders to stay focused on long-term progress alongside their immediate priorities for the coronavirus pandemic.

The COVID-19 pandemic has highlighted the need to have a business continuity and disaster recovery plan and a pandemic plan in place.

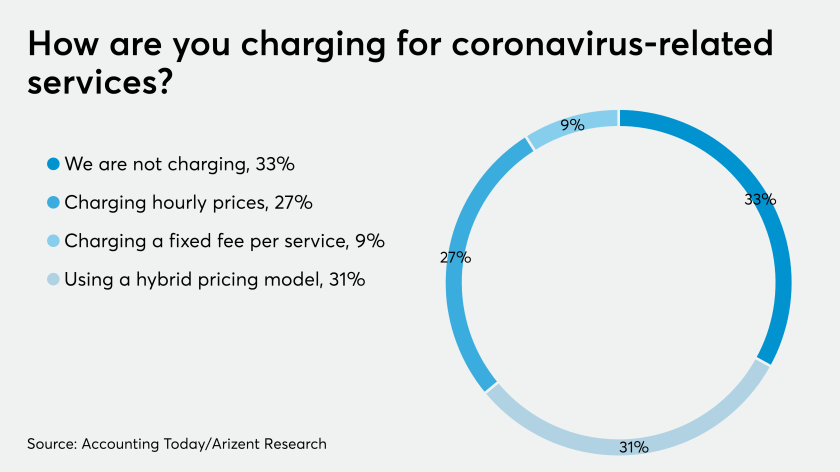

Firms may want to trade short-term cash for long-term goodwill.

The “new normal” of COVID-19-influenced retail is actively being exploited by fraudsters, as LexisNexis Risk Solutions finds fraud costs for U.S. retailers rising in 2020 by 7.3% over last year’s data.