Senate and House Republicans introduced legislation that would give businesses refundable tax credits against payroll taxes to meet some of the expenses associated with reopening during the novel coronavirus pandemic.

The American Institute of CPAs offered six policy suggestions for the next phase of federal COVID-19 relief legislation under consideration in Congress.

Business models and adaptability will determine the success — or failure — of financial technology companies as they deal with fallout from the coronavirus outbreak.

Democrats in New York, the world’s financial capital, may finally have the right moment to resurrect the state tax on stock trades.

The speed and scale of the Paycheck Protection Program made it particularly susceptible to fraud, explains Juliette Gust, a forensic accountant and founder of Ethics Suite -- and that means businesses need to take steps to protect themselves.

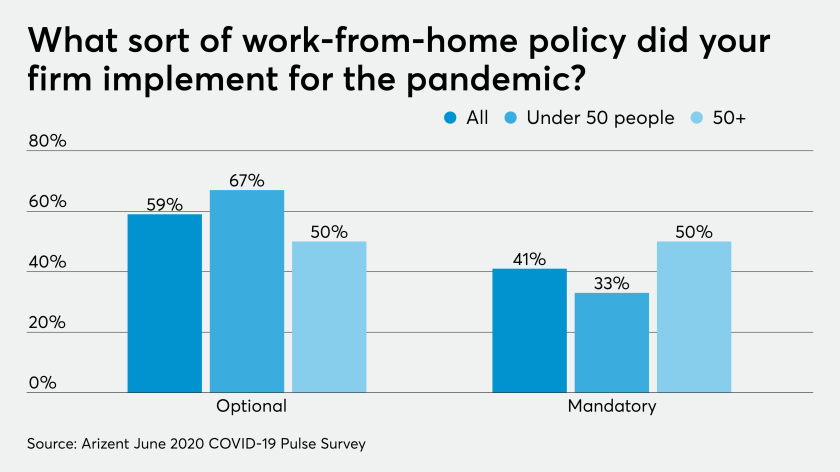

We are not back to normal, and WFH is not a perk … yet.

Over a hundred members of Congress are asking the service to resolve a number of issues preventing the remaining Economic Impact Payments from going out.

Accountants have no need to return to crowded offices, especially not in states where COVID-19 is having a second wind.

The White House is signaling to Congress that President Donald Trump could reject a new coronavirus aid bill if it doesn’t include a payroll tax cut, adding a new complication to already contentious negotiations between Republicans and Democrats on the next round of stimulus.

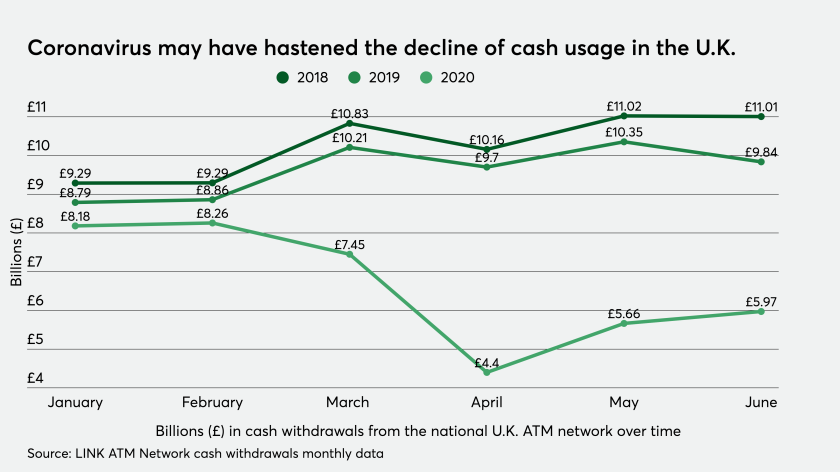

The coronavirus pandemic has cast a shadow over the use of cash, which is often perceived as dirty because it frequently changes hands and is almost never washed.