Hospitality sector credits are coming out of forbearance just as coronavirus cases surge. Restructurings and charge-offs could mount unless vaccine distribution happens quickly enough to jump-start travel by mid-2021.

The American Institute of CPAs is firing back after a congressional hearing, asking for penalty relief for taxpayers dealing with the pandemic.

Taxpayers around the world lose at least $427 billion each year to individual tax evasion and multinational corporate profit-shifting, which undercuts public funding for a COVID-19 response, according to a new report.

The top Republican and Democrat on the Senate Finance Committee said the Treasury Department “missed the mark” in new guidance that limits tax breaks for businesses that get their Paycheck Protection Program loans forgiven.

The guidance clears up the tax treatment of expenses when a loan from the Paycheck Protection Program hasn’t been forgiven by the end of the year.

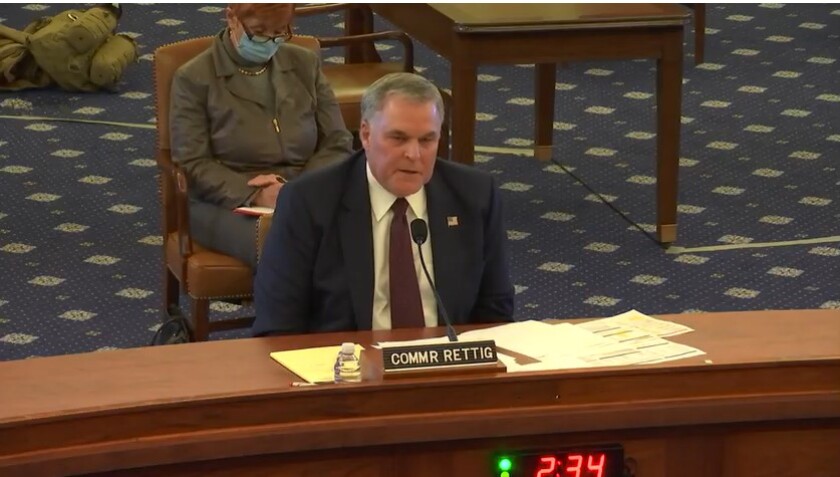

The pandemic is throwing a monkey wrench into plans for the Internal Revenue Service to reorganize itself to provide better taxpayer service.

Nearly one-third of companies are reducing their overall real estate footprint as a result of the COVID-19 pandemic, with 31 percent of companies renegotiating leases for more favorable terms, according to a new report.

Employees working remotely during the coronavirus pandemic claimed some outlandish expenses this year, including pricey exercise bikes, facelifts and private jets.

Between the pandemic, aging CPA firm owners and staffing tensions, many in the accounting profession anticipate a huge uptick in firm mergers and acquisitions over the next 24 months.

The single-family house on Forestview Avenue in Euclid, Ohio, a suburb of Cleveland, shows no signs of farming activity. The only things growing on the one-eighth-acre plot are trees, shrubs and grass.