The institute released the pair of reports as companies increasingly rely on their CFOs and accounting departments to help them survive beyond the coronavirus pandemic.

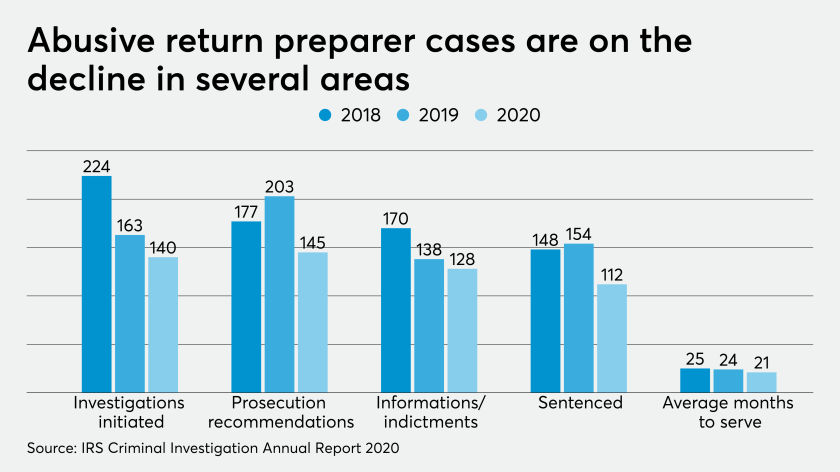

The Internal Revenue Service’s Criminal Investigation unit has been initiating fewer investigations of abusive tax return preparers this past year, while also recommending fewer prosecutions, and seeing fewer indictments and prison sentences this year.

The Governmental Accounting Standards Board is giving state and local governments extra time to implement its new leases standard because of the coronavirus pandemic, and they will need it.

The Federal Housing Administration said in its annual actuarial report that the capital reserve ratio on its mutual mortgage insurance fund increased to 6.10% in fiscal year 2020, up from 4.84% a year earlier.

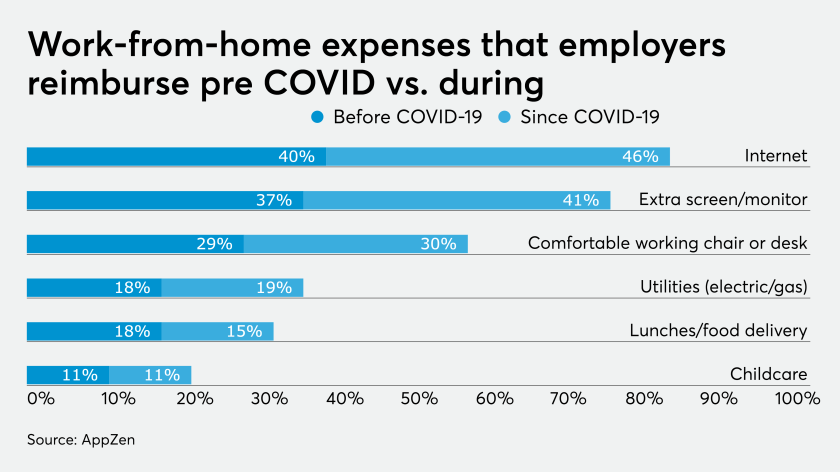

The percentage of workers asking for compensation for work-from-home expenses with their employers hasn’t gone up significantly since the outbreak of COVID-19.

The service is rolling out new systems and expanding forms that can be electronically filed by tax-exempt organizations.

Unemployment declined 1 percentage point to 6.9 percent as the economy continues a slow recovery despite the ongoing COVID-19 pandemic.

Wages are set to go up in Florida after voters passed a minimum wage ballot initiative in Tuesday’s election.

Having started his transition at the beginning of the pandemic, Board Chair Richard Jones now faces the uncertainty of the presidential election and what Congress might do with accounting standards.

As firms begin preparing for the busy season, what have we learned about hiring, training and working in a pandemic, and how can we prepare for the new normal?