The Internal Revenue Service is bracing for another epidemic -- scammers trying to get their hands on the $1,200 payments being sent out to millions of Americans to bolster the economy.

The board will "review the MSRB’s organizational response to the COVID-19 pandemic, including measures to ensure the safety of staff and stakeholders."

Even before the coronavirus pandemic, it was becoming clear that the work of the past decade to establish the Single Euro Payment Area was paying off with real-time payments networks and opening possibilities for another European payments scheme.

The SBA’s Paycheck Protection Program is nearly depleted, but there are ways small banks and fintechs, with help from Congress, can remedy the situation.

The pandemic is restructuring many of the calculations in mergers.

As universities move classes online, there are signs enrollment could be down in the coming academic year. That could have a major impact on credit unions’ private student loan portfolios.

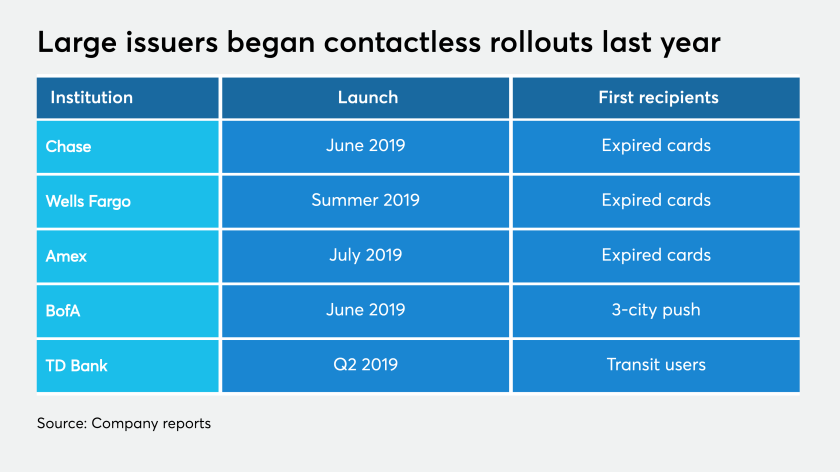

Though NFC adoption is still somewhat patchwork in the U.S., new data suggests contactless payment transaction volume is rising during the coronavirus outbreak, giving an advantage to banks and merchants that enabled it early.

Online lenders, core providers and software companies have created digital platforms that speed up and simplify Paycheck Protection Program loans for businesses reeling from the coronavirus pandemic.

Illinois has spent about $170 million on coronavirus-related expenses so far, and Gov. J.B. Pritzker said more information on the budget impact is coming.

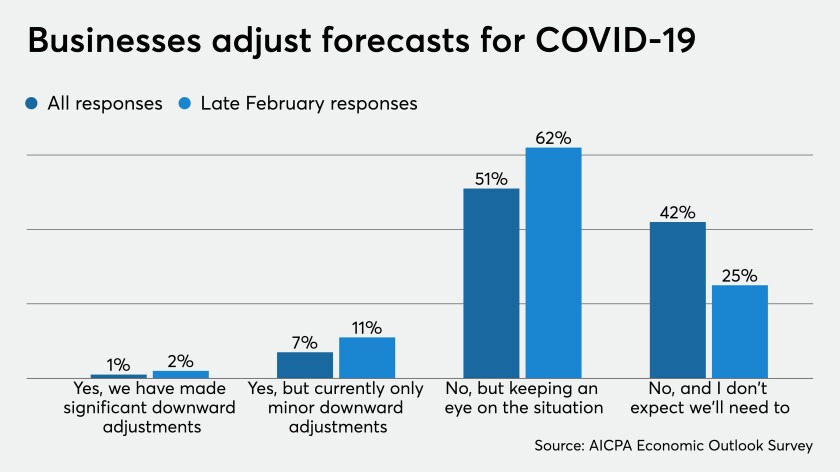

Its prediction that business conditions will remain weak this year — and into next year — stands in stark contrast to forecasts from political leaders that the economy will rebound quickly from the coronavirus pandemic.