Small businesses are dealing with frustrating delays and changing guidance in applying for and receiving help from the Small Business Administration in its new Paycheck Protection Program.

A trade group says suspending so-called beneficial owner rules would help financial institutions make more small-business loans through the Paycheck Protection Program.

Skilled nursing facilities and long-term care are deluged by the pandemic, adding financial stress for a sector that issues unrated and speculative grade debt.

Nearly everything fell during the difficult first quarter: net income, advisory assets, IRA assets, and advisor headcount.

More than 1,900 out of 2,180 cities surveyed recently by the NLC and U.S. Conference of Mayors are expecting budget shortfalls.

The Internal Revenue Service is encouraging taxpayers to file their taxes electronically during the three-month extension period for this year’s tax season.

The CPA Exam testing administrator stated that its test centers will now be closed through April 30, 2020, with a tentative May 1 re-opening.

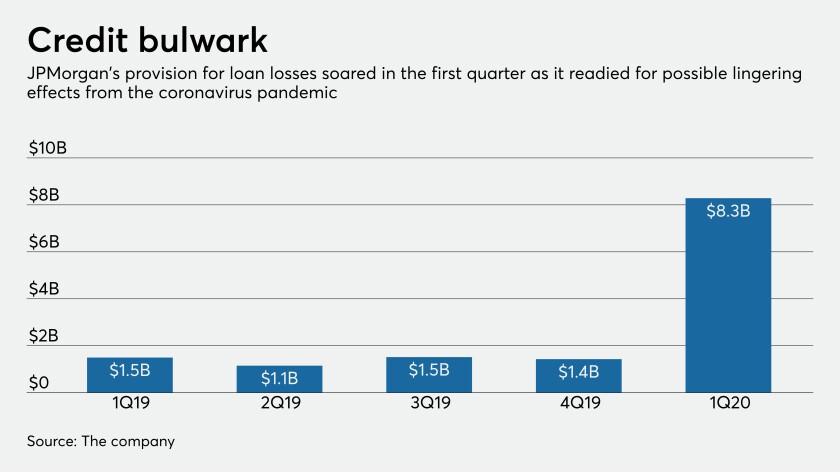

Though hopeful for a second-half bounceback in the economy, JPMorgan Chase is prepared for 20% unemployment, lackluster GDP and losses in its loan portfolio that could reach tens of billions of dollars.

Due to the coronavirus, a plant in Indiana may not be able to make its bond payments.

Unlike in 2008, banks have become a steady force during the coronavirus pandemic.