When Fiserv purchased First Data in 2019, it was part of an industrywide push to combine bank and merchant technology under one roof. A year later, a key piece of First Data’s technology — and its top executive — have become Fiserv’s path through the coronavirus crisis.

When the coronavirus pandemic began, Square pushed hard to get a bigger share of merchants' online sales and consumers' stimulus spending — and even received its long-desired bank license — but found that this wasn't enough to offset the effects of the crisis.

Despite PayPal's efforts to get people to receive — and spend — their stimulus checks from PayPal accounts, the coronavirus pandemic caused its revenue for the first quarter to come in below company guidance.

CEO Dan Arnold says the pandemic “will create some structural change across the market and the industry.”

Visa pulled its financial outlook for the rest of the year, but it already has visibility into permanent changes that result from the coronavirus — such as an aversion to handling cash.

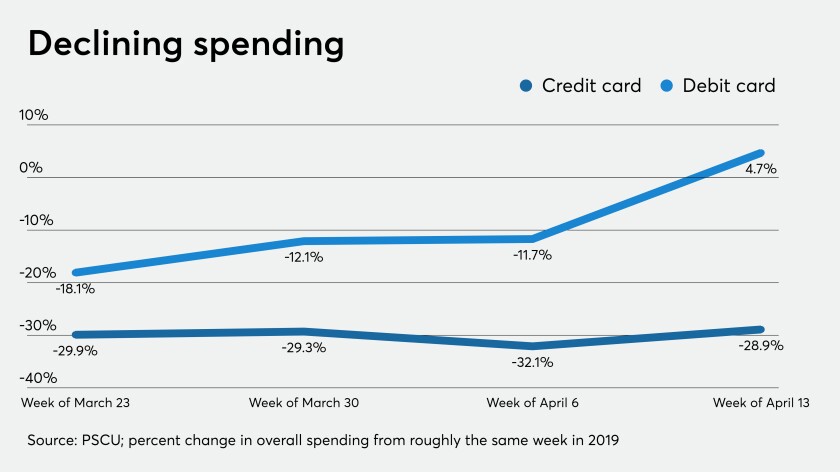

Consumers are using their debit and credit cards less, and that's causing a decline in interchange income for credit unions and banks.

The Federal Reserve chairman pledged to use every tool at the central bank's disposal to limit the economic fallout from the coronavirus and urged lawmakers to take further action.

Mastercard CEO Ajay Banga says he is certain that science, medicine and innovation will lead the world out of the coronavirus pandemic, but there is little indication of when that will happen.

The central bank expanded the reach of the program as pressure mounts on the government to support localities struggling economically because of the coronavirus pandemic.

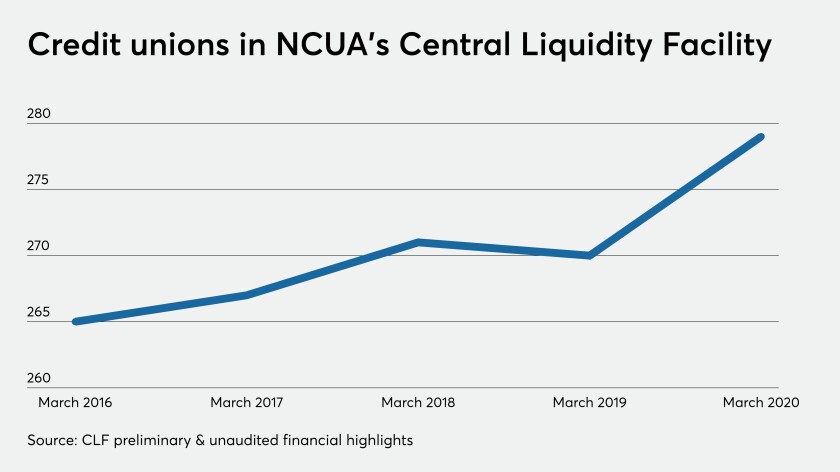

A credit union-specific liquidity backstop is far less popular than other options such as the Federal Reserve's discount window. The National Credit Union Administration wants to change that.