"We're now in a different world," Stephen Squeri, chairman and CEO of Amex, said during the card brand's first-quarter earnings call.

The central bank and other agencies have come under pressure to be transparent about their use of funds authorized by the recent pandemic rescue law.

The pandemic won’t halt the Cincinnati bank's plan to open about 100 branches in the Southeast, but features could be added to accommodate social distancing.

Executives say they can still meet their goal of $480 million in cost savings this year from the combination of BB&T and SunTrust despite unexpected expenses, unless the economy fails to rebound quickly.

The Senate Banking Committee chair will work with the heads of other panels in overseeing the $2 trillion stimulus package that Congress passed last month.

Consumers and businesses put more money in the bank as the pandemic worsened. How long the funds remain will depend on how quickly the economy recovers.

Businesses need strong predictive analytics to prepare for the way back.

Nearly everything fell during the difficult first quarter: net income, advisory assets, IRA assets, and advisor headcount.

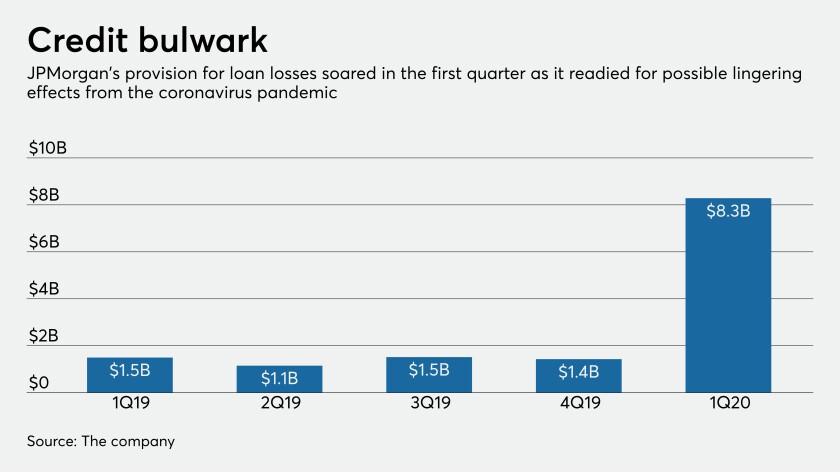

Though hopeful for a second-half bounceback in the economy, JPMorgan Chase is prepared for 20% unemployment, lackluster GDP and losses in its loan portfolio that could reach tens of billions of dollars.

By helping borrowers now, banks hope customers can quickly catch up on payments once the coronavirus pandemic ends. If they can’t, interest income will remain low and charge-offs could pile up if the crisis drags on.