As the time comes for businesses to apply for PPP loan forgiveness, CPAs can provide vital assistance to ensure success for their clients.

With only a few days to go before the end of a difficult year, some accountants and tax professionals are still hoping to finish up some perplexing issues for their clients before New Year’s Day.

Corporate catering provider ZeroCater launched a new personalized digital cafeteria to provide healthy meal options for remote employees and other essential workers.

Small business owners who got Paycheck Protection Program loans could qualify for big write-offs from their rescue money, amounting to what Treasury Secretary Steven Mnuchin has called a tax-break “double dip.”

Lawmakers are seeking to address some of the PPP’s more obvious failings in the latest coronavirus bill.

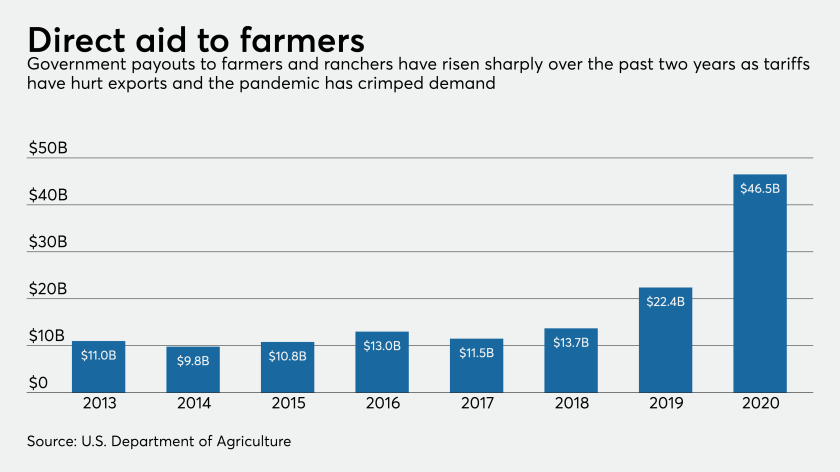

The Biden administration could curtail federal support for farmers, even with bankruptcies and requests for loan workouts on the rise. Banks are hoping that increases in crop prices and exports to China could help avert a credit crisis.

Executives from U.S. banks continue to play down near-term expectations, but they say customers are growing more confident ahead of the rollout of coronavirus vaccines, and that key commercial lending segments could drive an economic rebound.

The American Institute of CPAs has joined with over 560 business and trade organizations in urging Congress to pass legislation.

There are signs of a slowdown in the economy as businesses continue to struggle with rising COVID-19 infections across the country.

The guidance clears up the tax treatment of expenses when a loan from the Paycheck Protection Program hasn’t been forgiven by the end of the year.