Nearly one-third of companies are reducing their overall real estate footprint as a result of the COVID-19 pandemic, with 31 percent of companies renegotiating leases for more favorable terms, according to a new report.

The service is rolling out new systems and expanding forms that can be electronically filed by tax-exempt organizations.

Wages are set to go up in Florida after voters passed a minimum wage ballot initiative in Tuesday’s election.

For a few months this year, a U.S. government aid program meant for struggling small-business owners was handing out $10,000 to just about anyone who asked. All it took was a five-minute online application. You just had to say you owned a business with at least 10 employees, and the grant usually arrived within a few days.

CBIZ’s new offering helps businesses at various stages of COVID-19 recovery.

The Internal Revenue Service is reversing course on the automatic revocation notices that it sent to more than 30,000 tax-exempt organizations.

Many of the Buffalo, N.Y., bank’s commercial loans have exited forbearance granted in the early days of the pandemic — except hospitality and retail, which were given longer dispensation.

Accountants and tax professionals have been helping their small business clients deal with the economic fallout from the COVID-19 pandemic, shifting away from their routine compliance work after the end of the prolonged tax season.

The U.S. Small Business Administration and the Treasury Department are making it easier for companies to get their Paycheck Protection Program loans of $50,000 or less forgiven.

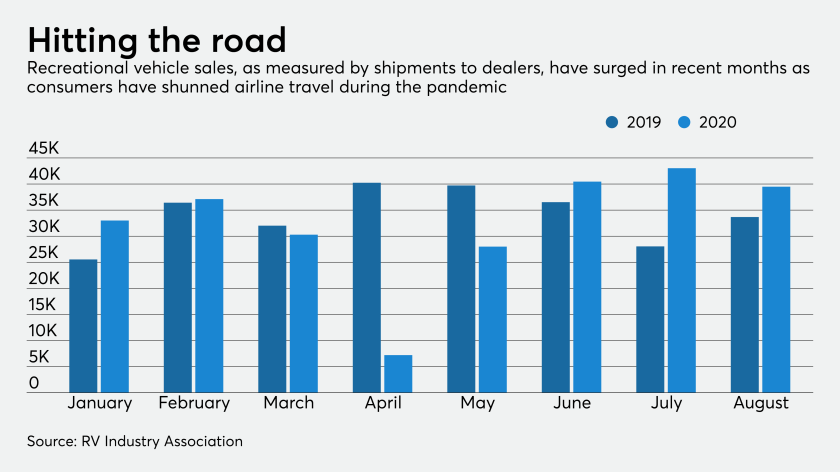

Many consumers are taking to the highways and the water for safe getaways during the pandemic — powering one of the few bright spots in lending. However, bankers warn that boomlets usually come with distinctive credit risks.