Federal government stimulus measures could be on the way, as volatility in the stock markets continue and coronavirus spreads. We check in with dealmakers from Riverside, Merrill Corp. and Paul Hastings about the potential impact on mid-market M&A. In PE news, Blackstone backs healthcare technology company HealthEdge.

There may only be so much institutions can do if the outbreak affects borrowers' ability to repay credit.

Mortgage companies that borrow heavily to keep their operations running may face financial pressure from coronavirus-related market volatility as it affects the valuations of collateral securing their financing.

The outbreak and a free fall of oil and stock prices are rattling bankers at this year's ICBA gathering in Orlando, Fla.

S&P Global Ratings is postponing a March 31 forum on public housing bonds due to concerns about the outbreak of COVID-19.

The Metropolitan Pier and Exposition Authority updated its latest offering statement to warn of the risk posed to its bottom line as did two systems with upcoming deals.

More buyers are seeking protection if a target suffers from implications from the coronavirus, a recession or an industry downturn.

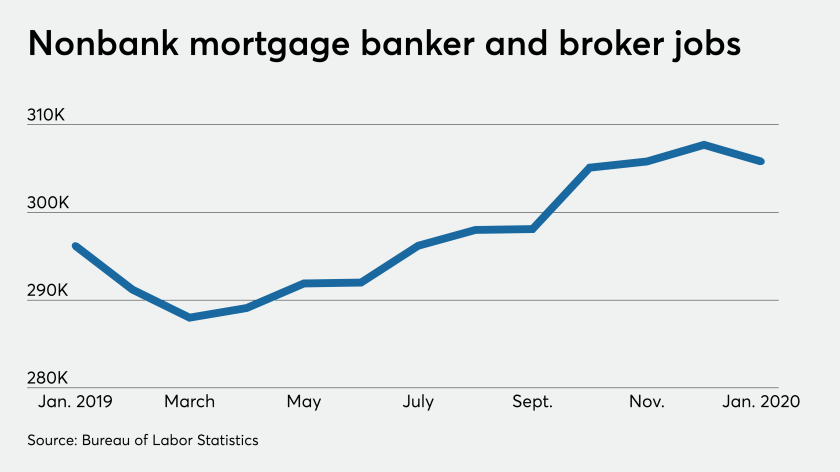

Nonbank mortgage employment fell in January, but could subsequently surge as lenders seek to capture business while rates are low, the job outlook is favorable, and the coronavirus is contained.

As businesses change strategy and staff deployments quickly, their payment needs and flows will change rapidly, says BHMI's Jack Baldwin.

The job gains were mainly at big companies and largely came before the outbreak of the coronavirus in the U.S.