Private capital fundraising posted a banner year in 2019 led Blackstone closing the largest buyout fund ever. AEI, Vista, Summit, involved in PE-related deals. Houlihan Lokey and Lincoln among top investment banks. Audax and Genstar rank among top PE firms.

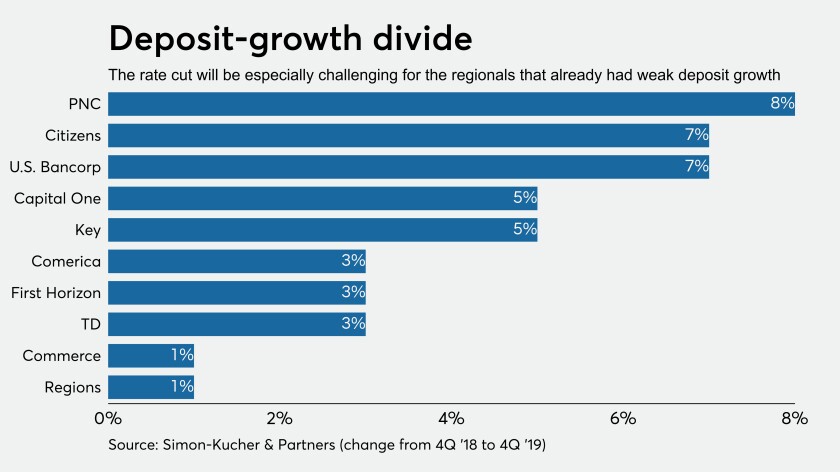

The Fed’s decision to cut its benchmark interest rate amid growing coronavirus concerns is bound to have an impact on banks, but just how broad and how deep remains to be seen.

The pace of small-business job growth accelerated for the third month in a row in February, according to payroll giant Paychex, but the rate of hourly earnings growth slipped.

Canada's housing market is poised for a hot spring — with lower mortgage rates likely to offset any major drag from the coronavirus.

Thermo Fisher buys coronavirus test maker Qiagen in biggest healthcare of the deal of the year. Bregal Sagemount raises third fund. In more PE news, AEI, GTCR and FP make deals.

When a new coronavirus emerged out of China in January, Qiagen got to work on a test to detect the virus in bodily fluids. The test is now being evaluated at four hospitals in China and one in France. The diagnostic gives results in about one hour.

Policymakers may not wait until their mid-month meeting and could act with other central banks.

The Massachusetts senator and presidential candidate sent a letter to CEOs of five of the largest U.S. banks asking about their response to the outbreak.

As the COVID-19 virus spreads globally, many U.S. financial institutions are said to be taking steps to protect employees and minimize disruption. But only a handful are sharing specifics, to avoid contributing to any public panic.

Stock market volatility underscores fears of global shortages of manufactured goods due to the coronavirus. We check in with dealmakers on the potential impact. Corsair Capital raises fifth fund. Audax, HarbourVest and Genstar named top three most active PE firms in U.S. deals.