More than a third fear the fallout from the coronavirus pandemic could drag into 2022 or later, and they are most worried about commercial real estate loans, according to a Promontory Interfinancial Network survey.

The economy showed signs of recovery despite the spread of the coronavirus across many parts of the country.

Bento for Business, a spend management system, is looking to assist small and midsize businesses with surviving through the COVID-19 pandemic.

The owner of The Shuckery in Petaluma, Calif., says she was unable to get a Paycheck Protection Program loan until she responded to an email from the delivery service and BlueVine.

The emergence of new coronavirus hotspots, especially in the South and West, had a major impact, according to a new report from payroll giant Paychex.

This personal funding has blurred the line between personal and business finances more than ever.

The provider of payroll, benefits and human resources for small businesses, is rolling out a program for accountants who want to be certified in providing the company’s services to their clients.

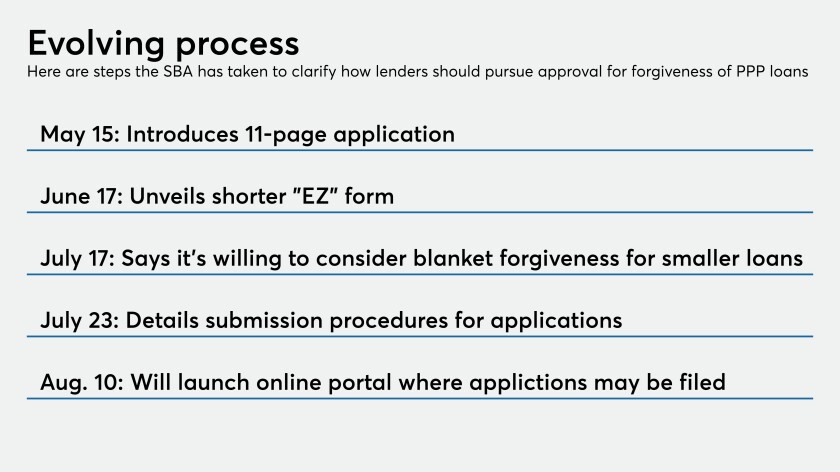

A new Small Business Administration notice explains what steps lenders must take to seek approval of their forgiveness decisions under the Paycheck Protection Program. But lenders say lawmakers and regulators must do more to cut red tape.

CEO Greg Carmichael says the Cincinnati company has cut expenses but will proceed with branch openings in the Southeast and investments in its commercial loan and mortgage origination platforms to lay the groundwork for post-pandemic growth.

Hospitals margins could sink to unsustainable negative levels in the last half of the year, according to forecasts.