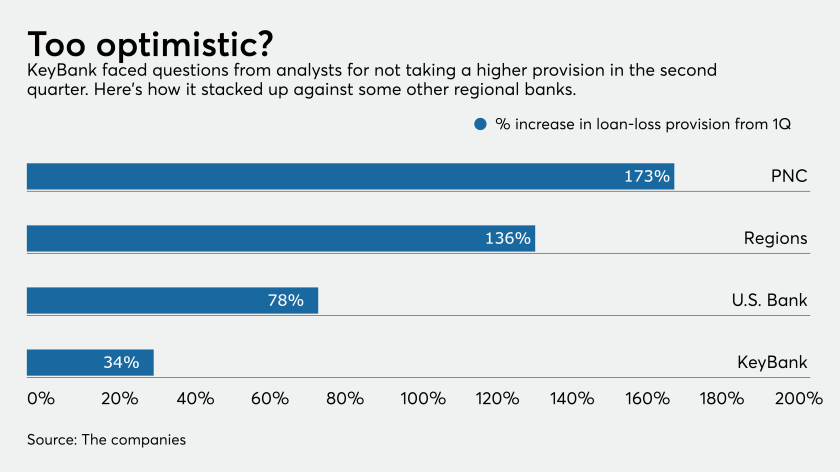

Other regionals set more aside for loan losses than the Cleveland bank did in the second quarter, and its ratio of reserves to total loans is slightly lower, too. But Key executives say the portfolio is balanced and holding up well despite the pandemic’s economic toll.

The Dallas bank set aside less in the second quarter for credit losses than analysts expected. Executives cited action in Texas and California to reverse reopenings and said they're still committed to the oil and gas business.

The Federal Reserve, U.S. Mint and financial industry representatives are strongly considering a public call for Americans to deposit their spare change, among other fixes, to get coins circulating again. Meanwhile, banks of all sizes are getting creative at the local level.

Senate and House Republicans introduced legislation that would give businesses refundable tax credits against payroll taxes to meet some of the expenses associated with reopening during the novel coronavirus pandemic.

Business models and adaptability will determine the success — or failure — of financial technology companies as they deal with fallout from the coronavirus outbreak.

Some criticized the Fed’s decision to temporarily lift capital restrictions for megabanks, but the move will help ease the crisis.

The Senate and House passed bipartisan legislation to help nonprofits remain financially viable during the COVID-19 pandemic.

The Fed has already eased certain capital requirements in response to the coronavirus pandemic. It should avoid making any further adjustments to the surcharge, which is meant to keep global banks from creating systemic risks.

The company has established a fund that will provide capital, technical assistance and long-term recovery support to small businesses, especially minority-owned companies. The other megabanks are expected to donate their fees, also.

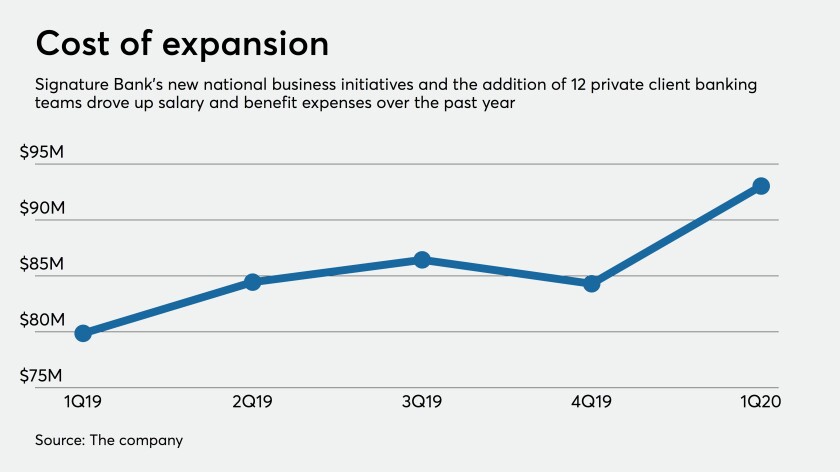

The New York commercial bank says geographic diversification is a long-term necessity and that the interplay of its private banking and commercial banking businesses has helped it withstand the economic shock of the coronavirus.