Business continuity plans should be used constantly, not just when the crisis is at its peak, says the New York Fed’s head of financial services.

Challengers like Joust, Lili and NorthOne that offer banking services to freelancers and small-business owners are getting record levels of new customers as the traditional workforce thins.

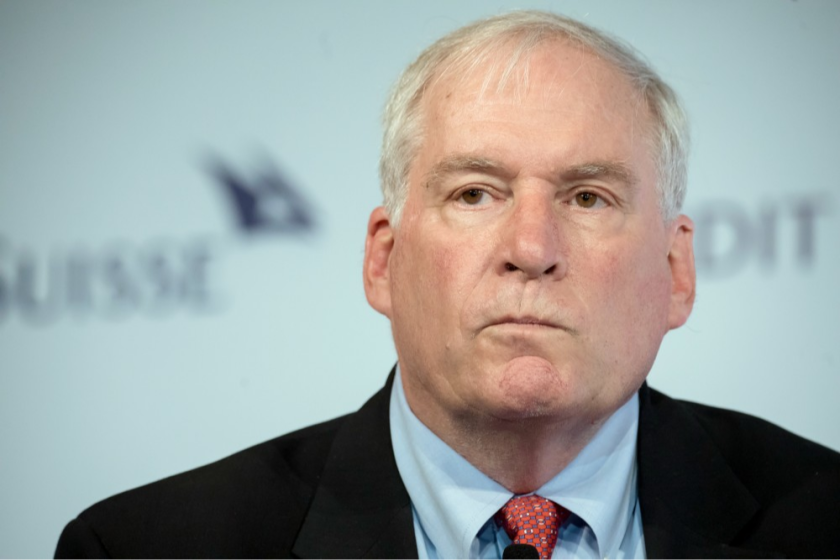

Participation in the Main Street Lending Program for midsize companies is partly about public service, but the core business rationale is building "a banking relationship that continues on for some time," the Boston Fed chief says.

Business owners are changing banks at three times normal levels, a trend researchers attribute to their difficulty in obtaining emergency loans. If the forgiveness stage of the Paycheck Protection Program proves arduous, that rate could climb much higher.

The Small Business Administration and the Treasury Department unveiled a simpler loan forgiveness application for the Paycheck Protection Program to reflect changes under the PPP Forgiveness Act.

The Wisconsin health system's ratings have weathered the early impact of COVID-19 on its balance sheet, although S&P revised its outlook to negative.

Nonprofits, lawmakers and others want to see more giving from fund donor-advised funds, which have grown popular recently because they’re so flexible.

Lawmakers shouldn't let themselves be misled by a slower pace in personal bankruptcy filings so far this year.

The institute released guidance on how to account for forgivable loans under the Small Business Administration’s Paycheck Protection Program.

The meeting was the last in chairman Russell Golden’s term.