The American Institute of CPAs has organized a coalition of 21 business trade groups to push for help for businesses' short-term liquidity needs.

The Trump administration released details of almost 4.9 million loans to businesses – from sole proprietors to restaurant and hotel chains – under the federal government’s largest coronavirus relief program so far, the $669 billion Paycheck Protection Program.

The House gave final last-minute congressional approval Wednesday to extending the popular loan program for small businesses until Aug. 8, hours after the deadline for applications lapsed with more than $130 billion still available.

Private sector employers added 2,369,000 jobs in June, according to payroll giant ADP, in a promising sign of business recovery despite the COVID-19 pandemic. ADP also revised upward its May total from a loss of 2,760,000 jobs to a gain of 3,065,000 jobs.

The Senate has passed an extension of the popular Paycheck Protection Program for small businesses, which was set to close down Tuesday night with more than $130 billion in funding left over.

Wealth management firms should define success by how well their operations perform under pressure, Kestra Financial COO Kris Chester says in an episode of Financial Planning’s podcast.

As small businesses in different parts of the country reopen in the midst of the novel coronavirus pandemic, they are beginning to increase the number of hours worked by their employees, according to payroll giant Paychex, although spikes in the virus are threatening to set back those gains.

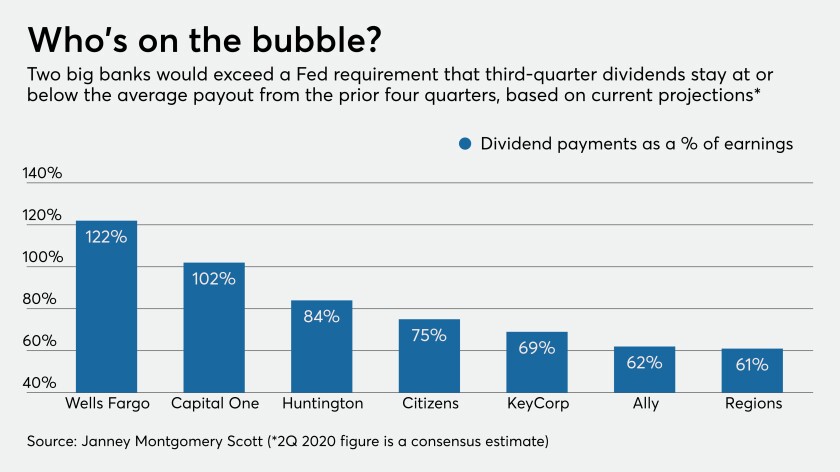

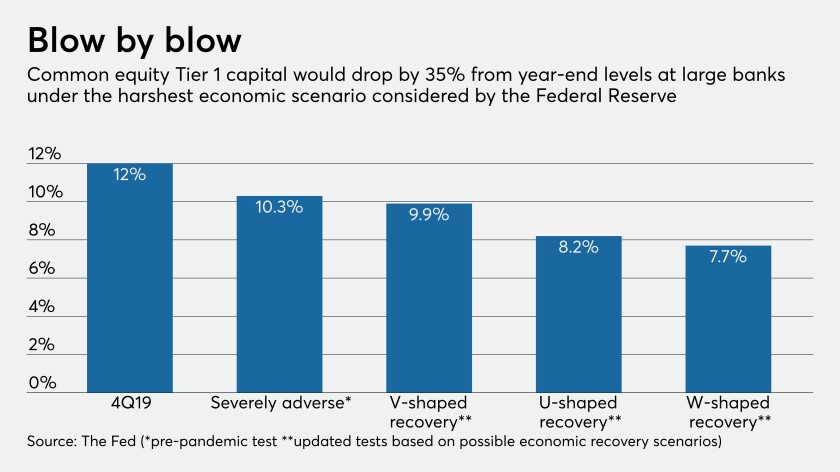

Some observers said the central bank should have suspended dividends entirely in response to an unprecedented economic emergency caused by the pandemic. Others said its more cautious moves were appropriate because big banks' capital is strong and the economy could bounce back.

In the most sweeping capital distribution order since the financial crisis, the Federal Reserve says it will prohibit big banks from buying back their stock in the third quarter and limit dividend payments to second-quarter levels.

The pandemic has created many great opportunities for finance pros to help their clients.