Members of both parties raised concerns that the requirements for participating in the Municipal Liquidity Facility and Main Street Lending Program are too restrictive to benefit smaller localities and certain midsize firms.

The head of the U.S. central bank said its emergency credit programs were not designed to prop businesses up over the long term.

The Ohio Democrat's criticism of Rodney Hood, chairman of the National Credit Union Administration, echoed complaints from bankers that the regulator was using the chaos from the pandemic to push through changes.

The Federal Reserve chairman pledged to use every tool at the central bank's disposal to limit the economic fallout from the coronavirus and urged lawmakers to take further action.

The central bank expanded the reach of the program as pressure mounts on the government to support localities struggling economically because of the coronavirus pandemic.

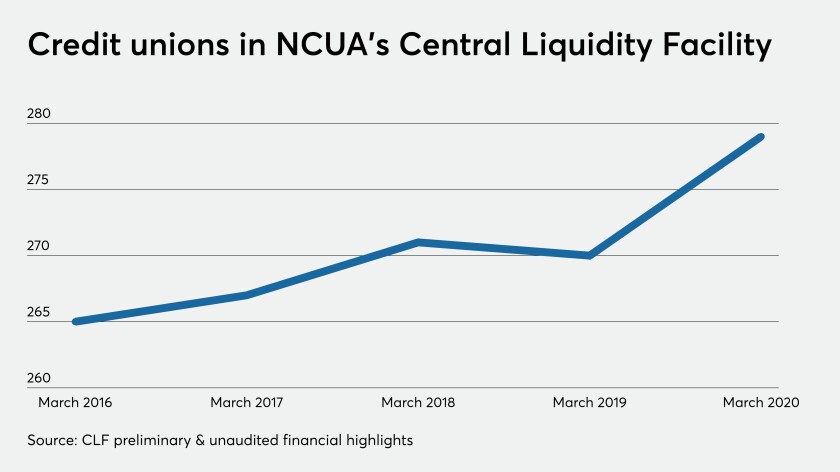

A credit union-specific liquidity backstop is far less popular than other options such as the Federal Reserve's discount window. The National Credit Union Administration wants to change that.

The central bank and other agencies have come under pressure to be transparent about their use of funds authorized by the recent pandemic rescue law.

The Senate Banking Committee chair will work with the heads of other panels in overseeing the $2 trillion stimulus package that Congress passed last month.

Midsize businesses and state and local governments are among the beneficiaries of the central bank's latest $2 trillion effort to mitigate the economic damage caused by the coronavirus pandemic.

While analysts agree banks are in better shape than in 2008, lawmakers are dusting off a crisis-era tool used by the Federal Deposit Insurance Corp. to soothe potential liquidity fears during the coronavirus pandemic.