While clients are uneasy about the spread of coronavirus, Kelly King touted the added volume his company has seen from lower rates.

Mortgage credit availability dropped slightly in February, making three consecutive months of tightening, but that streak will likely end with falling interest rates, the Mortgage Bankers Association said.

Mortgage companies that borrow heavily to keep their operations running may face financial pressure from coronavirus-related market volatility as it affects the valuations of collateral securing their financing.

Consumer sentiment for home buying stayed near its record high behind low mortgage rates and a strong job market, though the declining stock markets and COVID-19 concerns may change that soon, according to Fannie Mae.

Mortgage lenders could benefit from the surge in refinancing due to widening market spreads, and that could help offset damage to servicing rights portfolio valuations, according to Keefe, Bruyette & Woods.

Strong data and reassuring words from a Fed official couldn’t stop market virus fears from spreading.

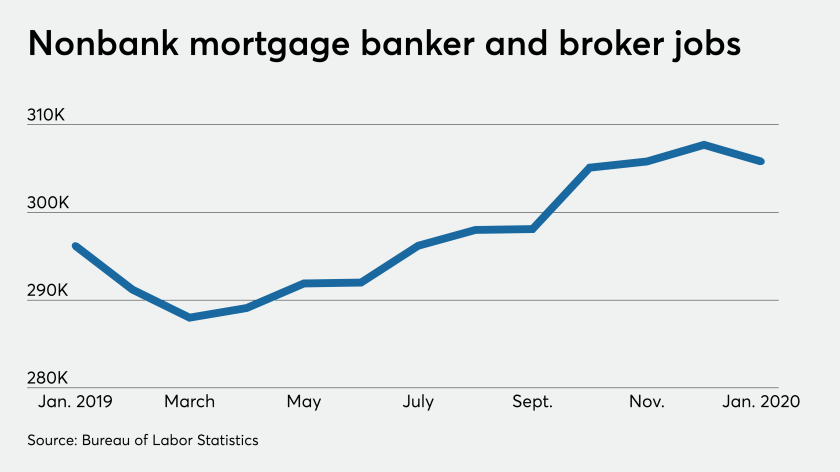

Nonbank mortgage employment fell in January, but could subsequently surge as lenders seek to capture business while rates are low, the job outlook is favorable, and the coronavirus is contained.

Even as concern over the rapid spread of the novel coronavirus mounts, the most recent data on area home sales from the Northwest Multiple Listing Service shows the market for Seattle-area residential realty remains hot.

Capacity constraints among mortgage lenders are leading to wider spreads between mortgages and the 10-year Treasury yield even after it remained below 1% for an extended period this week.

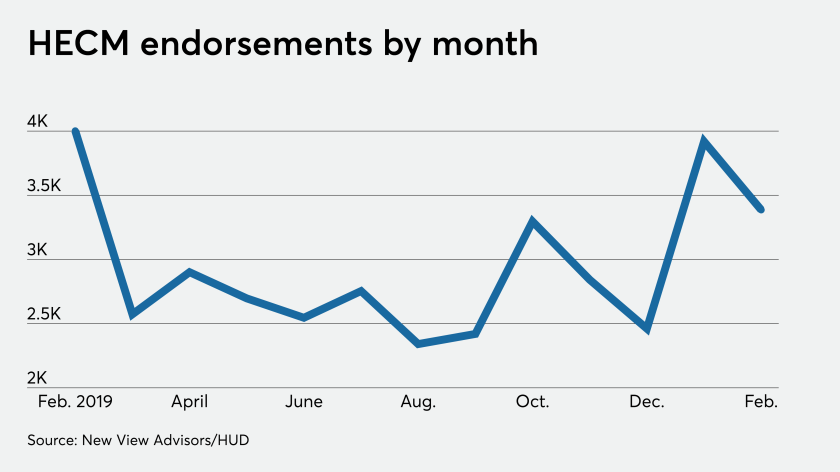

Endorsements of Home Equity Conversion Mortgages fell nearly 14% on a consecutive-month basis in February after a January surge, but stayed relatively strong compared to average levels last year.