The social and economic impact of the coronavirus, not necessarily Covid-19 itself, has homebuyers and sellers on edge and is changing the way Realtors do business.

Covid-19 and the economic fallout that has come with it are putting some homebuyers and sellers in the Twin Cities on edge.

No-interest loans and overdraft forgiveness are among the lifelines banks are offering to consumers and small businesses whose livelihoods are being upended by the economic fallout.

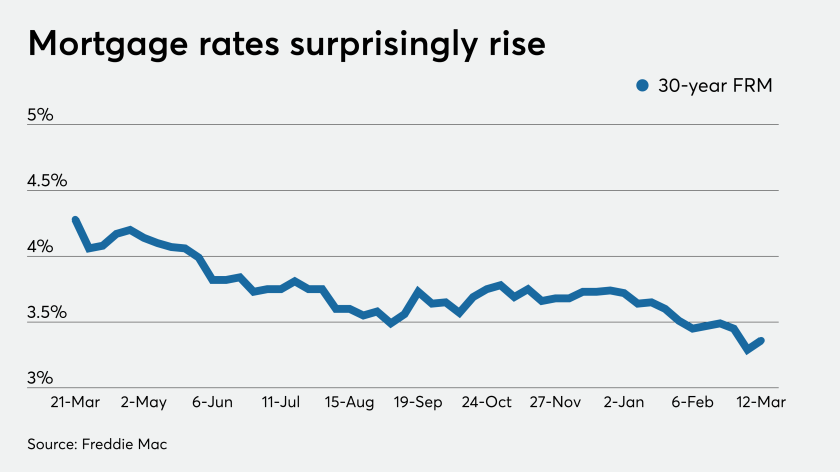

Increased refinancing volume led Fannie Mae to raise its 2020 estimate by $300 billion and 2021 projection by $280 billion.

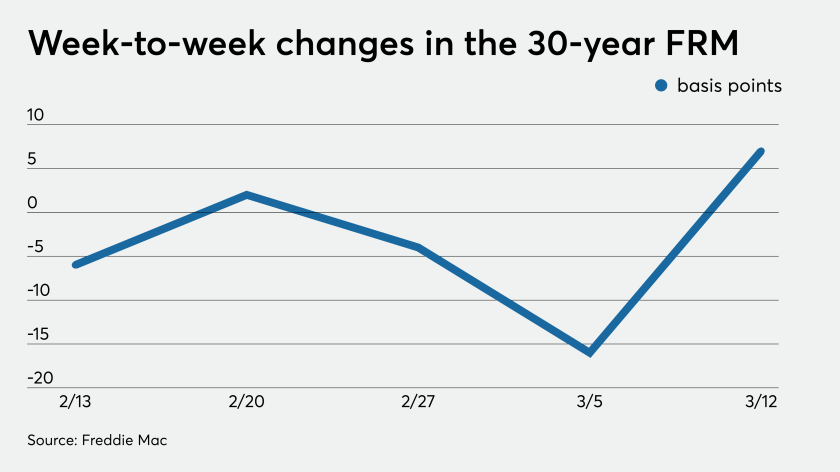

Not so long after Treasury bond yields experienced an unprecedented drop, the average 30-year mortgage rate rose, reflecting volatility related to the coronavirus as well as capacity issues on multiple levels.

Companies in the mortgage business were already focused on processing a lot of loans and generating efficiencies before the latest uptick in business hit.

Houston-area home sales experienced another double-digit gain in February as buyers came out in droves to take advantage of low mortgage rates.

Paradoxically, mortgage rates actually increased this past week, even as the 10-year Treasury yield plumbed new depths, likely because lenders are too busy to handle the influx of applications.

Bank of America cut its ratings and price targets on several homebuilders and building products companies as the firm is bracing for the "inevitable" coronavirus impact on the U.S. housing market.

The Mortgage Bankers Association raised its refinance projections for 2020, a move precipitated by an application volume increase of 55.4% from one week earlier.