Mortgage applications to purchase new homes took a small step back in February from record levels during the previous month, but further positive momentum could be blunted by the coronavirus.

Homebuilder sentiment fell to a four-month low in March as expectations of future sales dimmed amid a virus outbreak that threatens to dent activity across the industry and cause a recession.

With small businesses feeling the financial scourge of the coronavirus, bridge loans could be the direction they turn to keep things afloat.

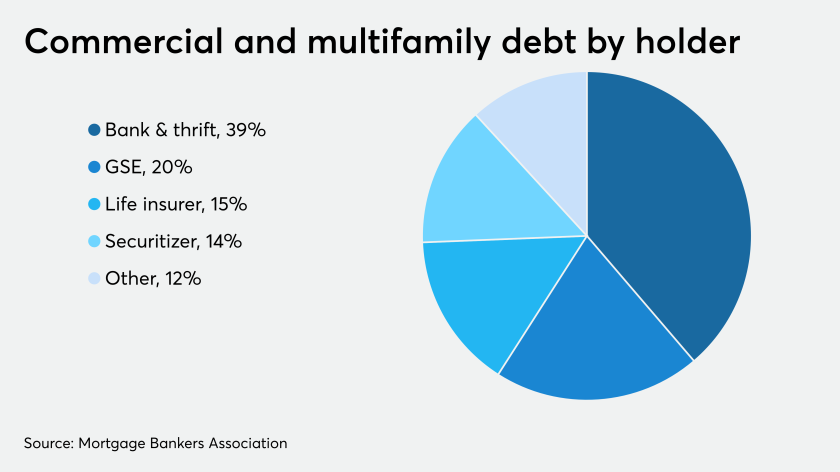

Add continued growth in commercial and multifamily mortgage debt outstanding to the list of things that the economic fallout from the coronavirus might affect.

The Federal Reserve's most recent economic-stimulus effort could reduce disparities between a rally in Treasurys and a relative slump in mortgage-backed securities that contributed to higher average home-lending rates last week.

Electronic closings are a solution in efforts to limit people congregating, but there could be some state law concerns.

A national moratorium would be costly to lenders and servicers, but proponents say it's needed to help cushion the economic blow of the pandemic.

The Conference of State Bank Supervisors on Friday launched a centralized link to state websites highlighting information relevant to business continuity plans for licensed mortgage loan officers.

Sports leagues have suspended their seasons. Organizers have canceled conferences. The coronavirus is starting to inflict economic damage as Americans hunker down to stop its spread.

Coronavirus is spreading in New York City. But when it comes to real estate, fear of contagion only slightly trumps fear of missing out on a deal.