My broker-dealer warned that since it’s a forgivable loan it could be seen as a compromise with creditors.

The House is expected to vote later this week on the bill expanding emergency relief for small businesses reeling from the effects of the coronavirus.

John Pitts, policy lead for Plaid, has some ideas to ensure Paycheck Protection Program legislation set to be voted on this week targets the companies most in need of a cash infusion.

Lawmakers are considering a plan to reserve at least $50 billion in Paycheck Protection Program funds for customers of community banks and small regionals.

From stimulus checks to the Paycheck Protection Program, the government’s infusion of cash into an economy reeling from the coronavirus pandemic has primarily helped those who already strong banking relationships.

The Senate Banking Committee chair will work with the heads of other panels in overseeing the $2 trillion stimulus package that Congress passed last month.

The Small Business Administration stopped approving loans when the Paycheck Protection Program hit its cap.

Online lenders, core providers and software companies have created digital platforms that speed up and simplify Paycheck Protection Program loans for businesses reeling from the coronavirus pandemic.

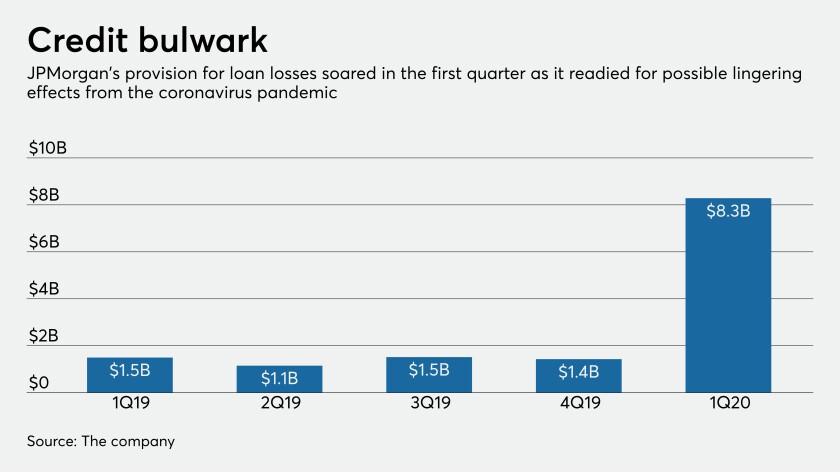

Though hopeful for a second-half bounceback in the economy, JPMorgan Chase is prepared for 20% unemployment, lackluster GDP and losses in its loan portfolio that could reach tens of billions of dollars.

PayPie is offering access to its network of Small Business Association-authorized lending partners to businesses seeking funds through the SBA Payroll Protection Program during the COVID-19 pandemic and economic slowdown.