As soon as the program was announced, I not only advised my small business clients to apply; I also tried to figure out how to take advantage of it myself.

It's time for agencies like the Small Business Administration to stop playing catch-up and invest in state-of-the art technology.

The Federal Reserve chairman pledged to use every tool at the central bank's disposal to limit the economic fallout from the coronavirus and urged lawmakers to take further action.

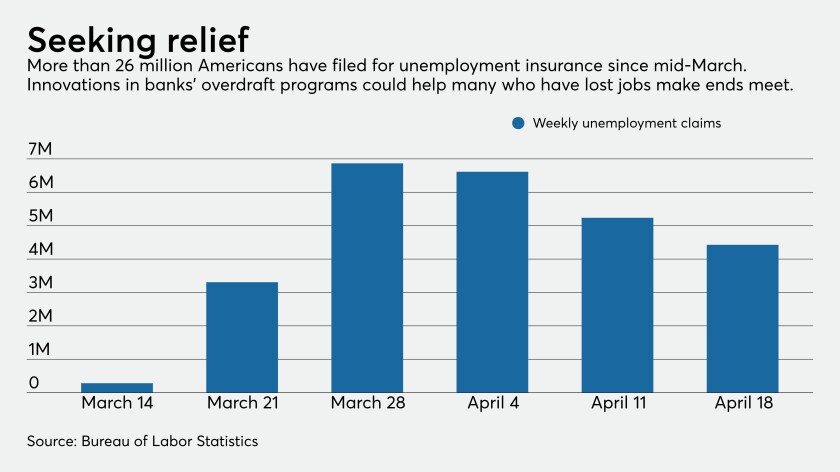

Some bankers, economists, policy experts and even Mark Cuban say that creative uses of overdraft programs could be lifelines for consumers and businesses whose finances have been upended by the coronavirus crisis.

Elected officials are better off deciding who’s most deserving of federally backed coronavirus relief funds for small businesses.

Queued-up loans. Extra bankers. Government tweaks to promote fairness. None of these precautionary measures has been enough for the second round of the Paycheck Protection Program to avoid the pitfalls of the first.

As banks accept new applications for the paycheck program, they are dogged by complaints that they prioritized wealthy borrowers. But lenders likely fast-tracked clients they knew best under difficult circumstances, observers say.

The central bank and other agencies have come under pressure to be transparent about their use of funds authorized by the recent pandemic rescue law.

The policy move will allow small institutions participating in the Paycheck Protection Program to pledge business loans as collateral to obtain advances.

Lawmakers should approve a program to distribute stimulus funds using a government-sanctioned coin, which would be speedier than the current system.