House Democrats proposed a $3 trillion virus relief bill Tuesday, combining aid to state and local governments with direct cash payments, tax breaks, expanded unemployment insurance and food stamp spending as well as a list of progressive priorities like funds for voting by mail and the troubled U.S. Postal Service.

Padgett Business Services’ Roger Harris suggests some exceptions for employers with fewer than 50 staff.

We have all spent so much time and energy applying for the Paycheck Protection Program, trying to interpret and decipher the intent behind the words.

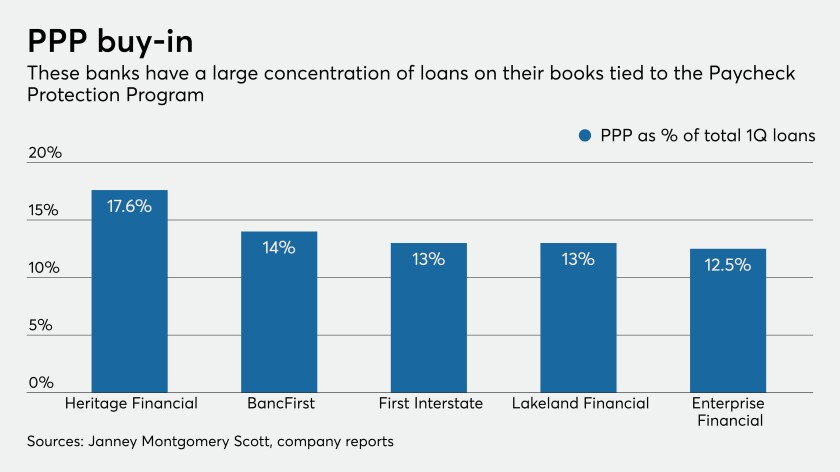

Banks could end up holding many low-rate Paycheck Protection Program loans on their books for two years, and dealing with irate borrowers who failed to meet federal requirements for forgiveness.

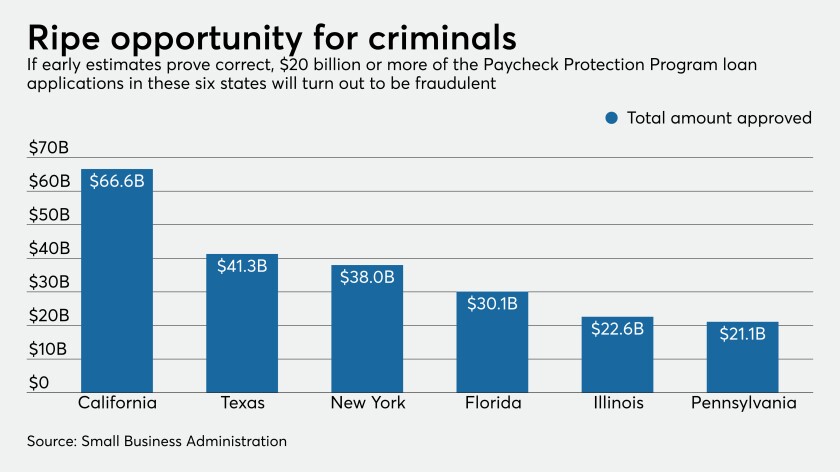

Up to 12% of loans under the $660 billion small-business rescue program could be tied to misleading or completely phony applications, fueling concerns about lenders' potential liability.

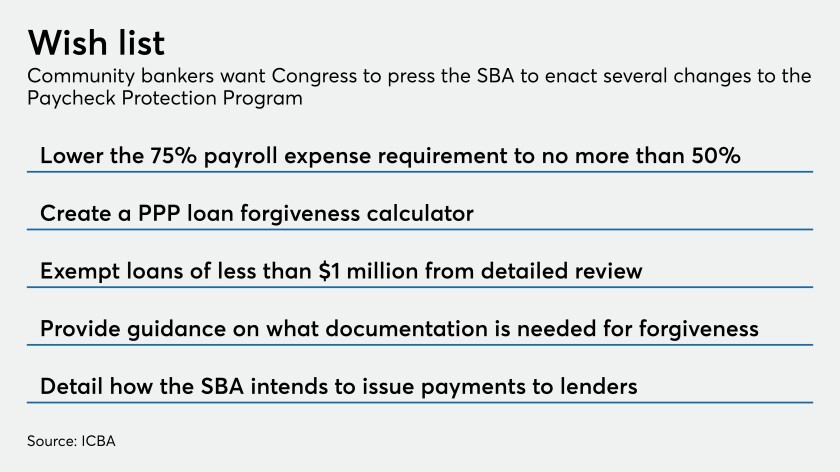

Regulators need to give more detailed guidance on the coronavirus relief program for small businesses so lenders don’t get trapped in underwriting mistakes down the road.

Bankers are bracing for accusations of discrimination in the way Paycheck Protection Program loans were allocated.

There's a great deal of help for businesses in the CARES Act and the FFCRA.

Financial advisors, broker-dealers, custodians and other firms are trying to do their part amid a public health and economic crisis.

Small businesses that manage to get their Paycheck Protection Program loans forgiven may find themselves losing valuable tax breaks, according to new guidance from the Internal Revenue Service.