A steadier market gave Wisconsin the opportunity to move last week on a long-stalled refunding that notably offered a forward delivery piece.

The Wisconsin health system's ratings have weathered the early impact of COVID-19 on its balance sheet, although S&P revised its outlook to negative.

Wisconsin officials are still assessing the potential impact on its general fund revenues.

Illinois tentatively plans to sell $1.2 billion of certificates next week and $1 billion of bonds the following week.

Due to the coronavirus, a plant in Indiana may not be able to make its bond payments.

The bond-financed $420 million expansion project moved forward over the objections of board members who questioned the timing amid plummeting tax revenues.

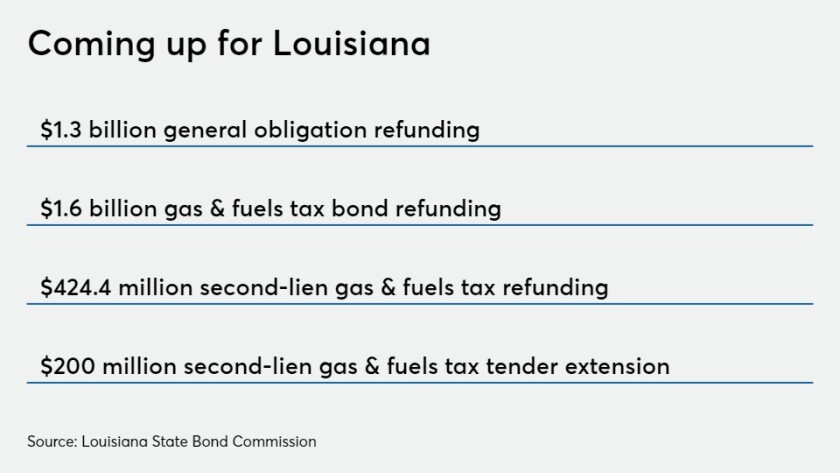

The Louisiana State Bond Commission authorized four bond issues, and was updated on market volatility created by the COVID-19 pandemic.

Most of the disclosures tracked since the beginning of the year were filed in March, the MSRB said.

To help state and local governments after the COVID-19 pandemic, Cumberland Advisors is proposing a new municipal security.

Municipal bond issuance was $67.88 billion after the first two months of 2020 and was on pace to easily eclipse the $400 billion mark — then COVID-19 completely turned the market upside down.