Due to the coronavirus, a plant in Indiana may not be able to make its bond payments.

Demonstrating compliance with pricing and supervision rules has been challenging in the COVID-19-influenced market.

Public finance advocates said the Senate bill has been broadened to authorize the Federal Reserve to purchase all types of bonds that are sold on the secondary market.

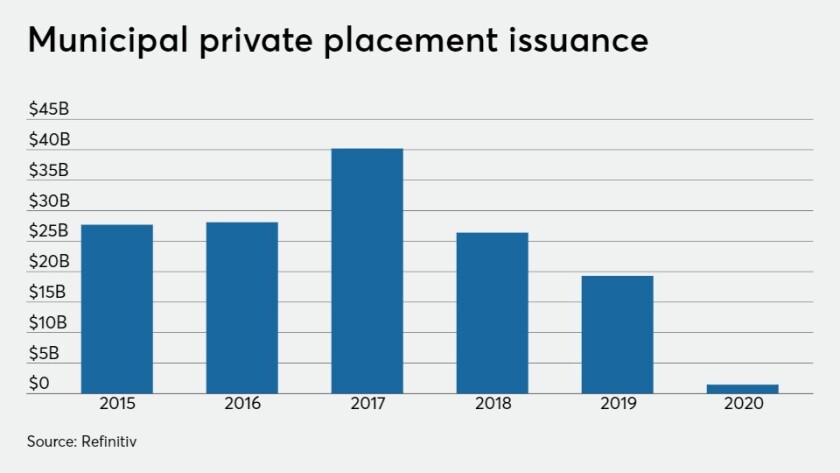

A big New York State Empire Development Corp. private placement is likely to be followed by more until the municipal primary starts functioning again.

Lipper reported a whopping $12.2 billion of outflows from municipal bond funds. Out of that huge number, $5.3 billion were from high-yield funds. The $12 billion figure of outflows in one week equates to about 3% of annual municipal volume.

A coalition of healthcare industry organizations is asking for $100 billion in direct federal help, warning that the survival of some hospitals is at stake.

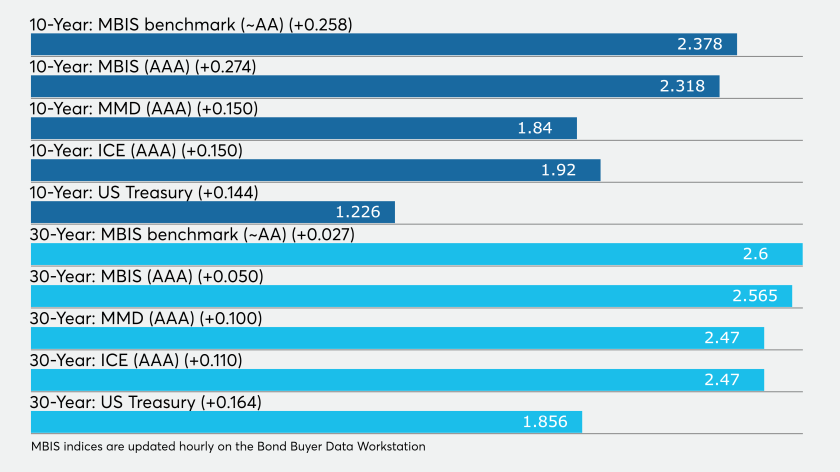

Benchmarks showed again that the short end was being hit hardest — 30 basis points up on the one-year and at least 10 up on the long end, but the entire curve was being cut drastically. The primary market was again at a standstill.

Tax-exempt municipal yields rose substantially last week causing the MSRB to take a look at trade data, said John Bagley, MSRB chief market structure officer.

The municipal market is dealing with a major liquidity event, with massive short-end selling.

The municipal finance industry is dealing with minute-by-minute news of state-wide school closures, shuttered restaurants, curfews and canceled events. New issues are increasingly being put on the day-to-day calendar.