Muni market players may have to rely on more than their basic instincts as the economy heads into stormy weather.

Uncertainty still abounds for the public finance space, as just before the market close, President Trump declared a national emergency. Meanwhile, states and cities across the country are closing schools, sporting events, and cutting back public transit. But Friday, at least, provided some reprieve from the five previous volatile days.

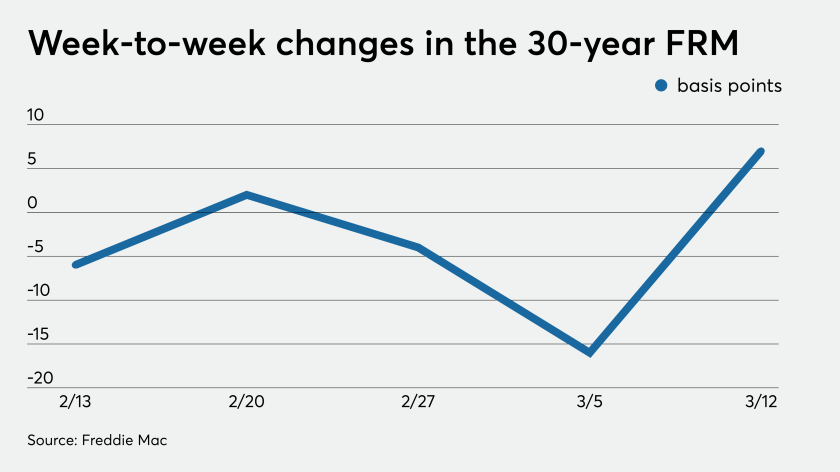

Not so long after Treasury bond yields experienced an unprecedented drop, the average 30-year mortgage rate rose, reflecting volatility related to the coronavirus as well as capacity issues on multiple levels.

Michael Zezas, managing director of research at Morgan Stanley, notes that muni yields have not fallen as quickly as the Treasury equivalents and recession risk climbs the longer the coronavirus persists. Layer on top of those items the incipient oil competition and quite a storm is brewing. Even liquidity is becoming "disorderly." John Hallacy hosts.

The municipal market was hammered Wednesday by the COVID-19 pandemic with a more than quarter point correction in AAA benchmarks, issuers pulling deals off the shelves and more reports of pricing and evaluation confusion.

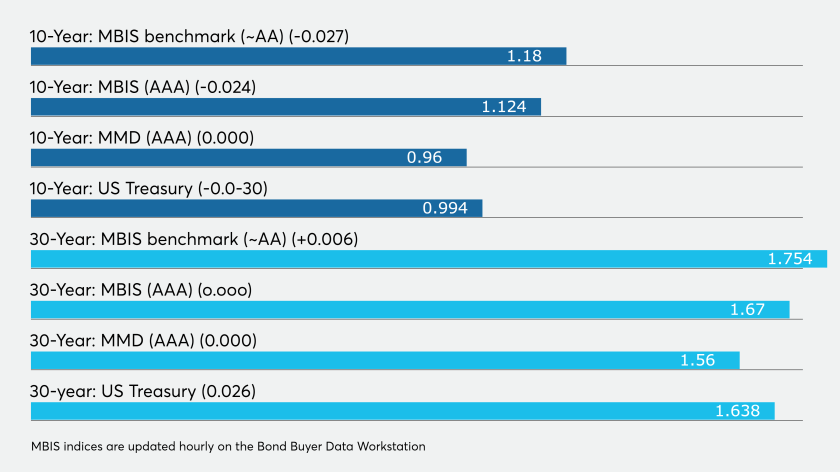

As COVID-19 wreaks havoc on global markets, munis try to keep pace.

As fear and uncertainty over COVID-19 rapidly grow, it has sent yields for both municipals and Treasuries to never before seen low levels — begging the question if we could see zero or negative yields here in the States?

The world remains on edge about the rapidly spreading COVID-19 and those fears once again have Treasury yields digging down even deeper. COVID-19 fears have now impacted fund flows, as municipals suffers outflows for the first time in 60 weeks.

It was a busy day in the primary, as the markets continue to deal with crosscurrents of COVID-19 and election results.

The municipal bond market is in for another action-packed week, with above-average issuance and COVID-19 still spreading rapidly.