In the current economic environment, it could be advantageous for you or your clients to consider a strategic acquisition.

The pandemic has forced states to consider where to tax work, but the rules remain tangled.

Despite lingering uncertainty over the U.S. election, the country’s ultra-rich already have plenty to celebrate from Silicon Valley to Illinois.

Revenue dropped 6 percent as the pandemic triggered economic shutdowns across the country, according to data from 44 states compiled by the Urban Institute.

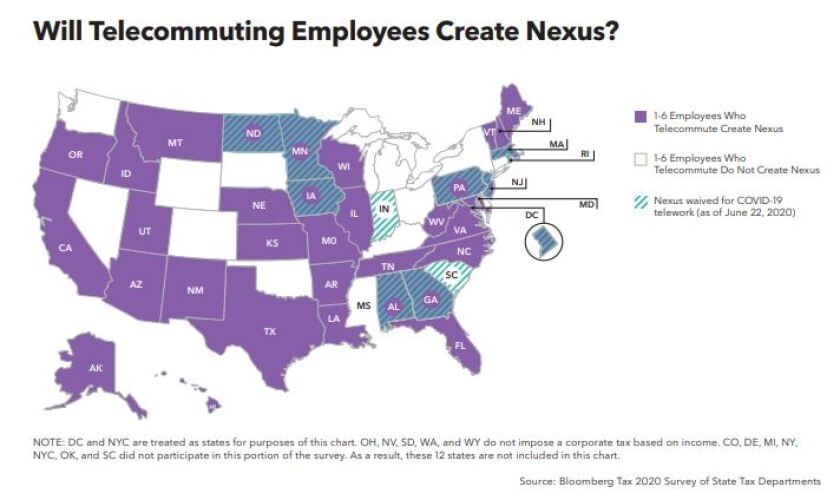

Mandated by the COVID-19 pandemic, remote work can also bring serious tax consequences.

Most of the Top 100 CPA firms reportedly are showing significant increases in revenue in their SUT practices.

In today’s COVID-19 world where nothing seems normal, and “new normals” are popping up in every business operation, service businesses are trying to make up for lost income and rising expenses in creative ways that will lessen the financial impact of COVID-19.

As far as the taxman is concerned, home is where the heart is.

Democrats in New York, the world’s financial capital, may finally have the right moment to resurrect the state tax on stock trades.

The majority of states are considering a company to have tax nexus if just a single employee is telecommuting from their state, according to a new survey, which could have wide implications for businesses as more of their employees work from home during the COVID-19 pandemic.