The pandemic is throwing a monkey wrench into plans for the Internal Revenue Service to reorganize itself to provide better taxpayer service.

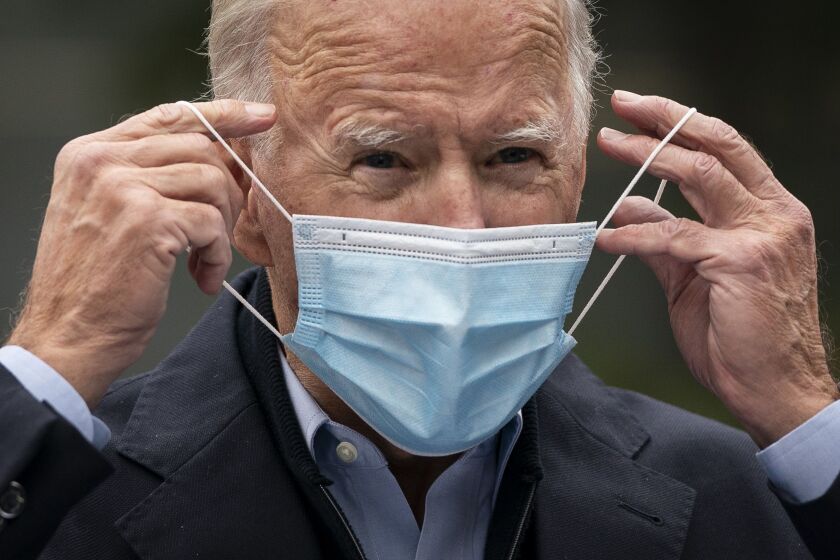

President Donald Trump spent months on the campaign trail taking credit for “opportunity zones,” a policy meant to encourage investment in distressed communities across the U.S. Joe Biden’s team sees potential in the idea, too.

The president-elect's pledge to repeal President Donald Trump‘s tax cuts as soon as he is inaugurated may be stymied for the foreseeable future.

Despite lingering uncertainty over the U.S. election, the country’s ultra-rich already have plenty to celebrate from Silicon Valley to Illinois.

The outcome of Tuesday’s election could be profound tax changes, but that’s only if one party wins control of both houses of Congress and the White House.

As the country looks to make its choice between two decidedly different candidates, tax preparers are watching the race play itself out from a unique vantage point.

Add in the complexities of this year’s presidential race, and we have a recipe for uncertainty and fear.

Former vice president and Democratic presidential candidate Joe Biden’s tax proposal will limit direct tax increases to just 1.9 percent of taxpayers.

Accounting firms Crowe LLP and BKD LLP released year-end tax-planning guides Wednesday, during a time of great uncertainty over future tax changes in the midst of the novel coronavirus pandemic and the upcoming election.

This article looks at a few key components of the presidential nominees' tax positions.