Senator Kamala Harris condemned the Trump administration’s handling of the pandemic as the worst failure in U.S. government history, but evaded answers on the Democrats’ positions on the environment and the Supreme Court.

During the 2020 presidential campaign, Democratic candidates made many proposals for changes to the Tax Code, ranging from changes to the tax rates to the imposition of a new 5 percent excise tax and a national sales tax.

Companies that took advantage of federal pandemic-relief efforts like payroll tax deferrals will face bigger bills next year.

Rep. Pete Olson, a Republican from Texas, has introduced a bill that would offer tax incentives to employers who train workers about best practices for reducing the spread of COVID-19 in the workplace.

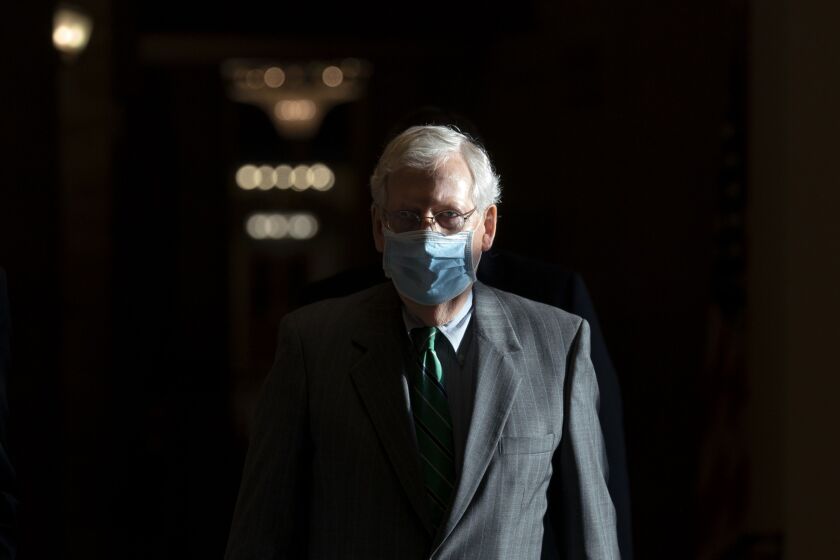

Senate leaders will be trying to hold their parties together for a vote Thursday to advance a slimmed-down stimulus bill that Democrats have already rejected, with both sides jockeying for advantage in public perceptions two months before the election.

Opportunity zones may just be the perfect vehicle to deliver economic relief to the areas hardest hit by the coronavirus pandemic — both short term and long term.

The Democratic presidential nominee Joe Biden expressed optimism and hope about overcoming the economic crisis and other challenges during his acceptance speech at the virtual Democratic National Convention.

President Donald Trump’s order to delay collection of payroll taxes thrusts a dilemma on U.S. companies: continue withholding the money from workers expecting bigger paychecks or pass it on and potentially put themselves or their employees at risk of a big end-of-year bill from the IRS.

U.S. Senator Bernie Sanders said he will introduce legislation to tax what he called the “obscene wealth gains” from billionaires during the coronavirus crisis.

President Donald Trump said he is “talking about” doing a payroll-tax cut through an executive action, but doing so could result in hefty tax bills for employers later if the idea doesn’t get mired in legal challenges before then.