Several unemployed workers described the difficulties they are facing to senators as congressional leaders continue negotiations.

Here’s what CPAs and their clients need to know when hiring an employee.

Dozens of millionaires from the U.S. and six other countries have a message for their governments: “Tax us. Tax us. Tax us.”

Tax pros share what they’re telling clients about relief for the jobless during the pandemic.

Nonprofits, lawmakers and others want to see more giving from fund donor-advised funds, which have grown popular recently because they’re so flexible.

The act increased many of the limits from the Tax Cuts and Jobs Act, and the IRS has offered more guidance.

From more OICs and higher state taxes, to managing NOLs and the long-term ramifications of the PPP, experts advice predictions for practitioners.

Pandemic-induced market volatility and warnings from Wall Street that tax rates are bound to rise have more Americans preparing to move money from traditional individual retirement accounts into Roth IRAs.

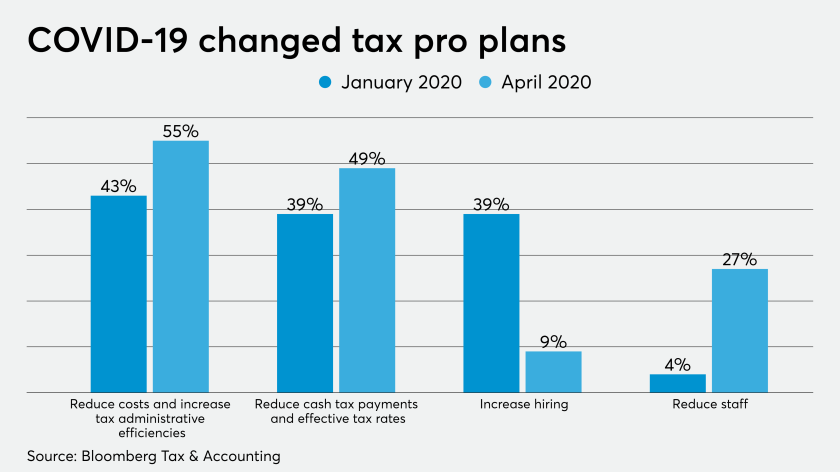

The COVID-19 pandemic is forcing corporate tax departments to reconsider their top priorities for this year, according to a new survey.

Divorce and COVID-19 each bring various tax considerations.