There's a great deal of help for businesses in the CARES Act and the FFCRA.

Rich Americans are taking advantage of an unprecedented opportunity, made possible by the coronavirus pandemic, to transfer money to their children and grandchildren tax-free.

The novel coronavirus pandemic is causing the biggest drop in Americans’ financial situation in over a decade.

In a down economy, international planning is even more important.

Recipients of Social Security benefits, as well as railroad retirement and veterans benefits recipients, will need to act fast.

These direct payments are intended to provide direct assistance to American taxpayers who have lost wages, jobs or opportunities because of COVID-19. But there is some fine print.

From Roth conversions to QHFDs: The coronavirus pandemic is forcing difficult questions, and clients rightfully are looking for answers that advisors are uniquely suited to provide.

Can a home equity line of credit offer clients a bridge loan for troubled times? Says one, “I’m going to call those people and rehire them.”

The passage extends the IRA contribution deadline and waives RMDs for 2020. Here’s what else financial advisors need to know.

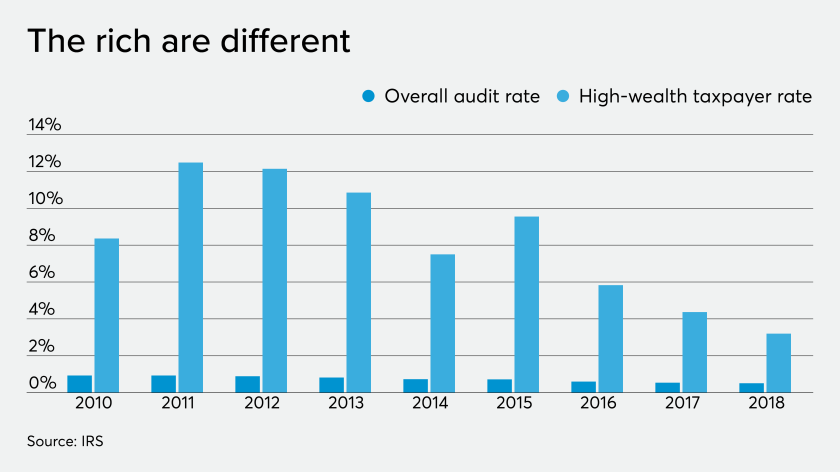

The richer they are, the more options clients have to insulate themselves from the coronavirus and its effects.