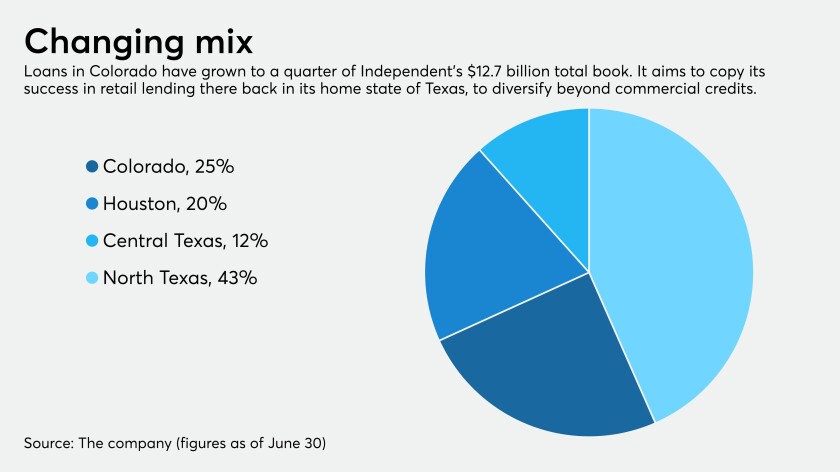

Now that its deal with Texas Capital has been called off, Independent Bank in McKinney plans to scale back or exit some commercial lines and will seek to duplicate its retail banking successes in Colorado.

The pressure is on the fintech, which helps banks make digital loans, to stanch its losses and show its lofty market valuation was deserved.

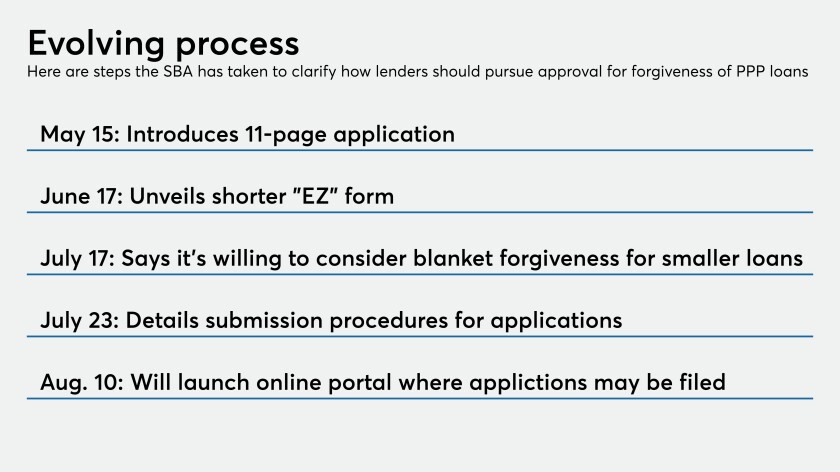

A new Small Business Administration notice explains what steps lenders must take to seek approval of their forgiveness decisions under the Paycheck Protection Program. But lenders say lawmakers and regulators must do more to cut red tape.

Lenders need to use alternative data as an overlay to traditional underwriting methods to help creditworthy customers in hardship because of the coronavirus crisis.

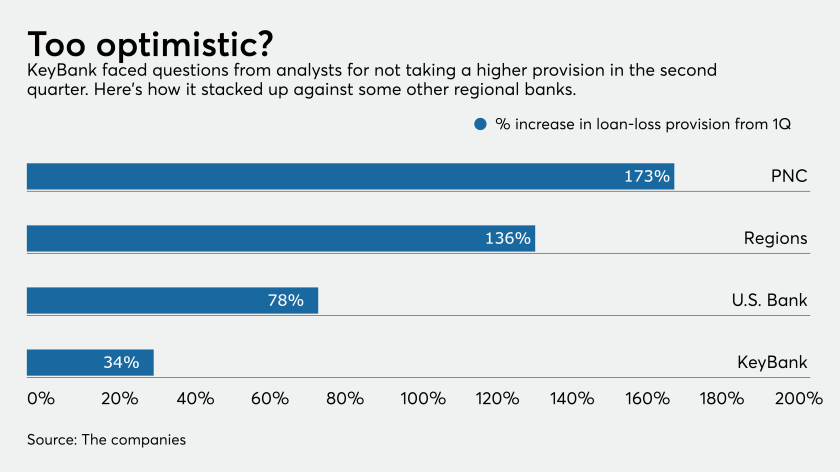

Other regionals set more aside for loan losses than the Cleveland bank did in the second quarter, and its ratio of reserves to total loans is slightly lower, too. But Key executives say the portfolio is balanced and holding up well despite the pandemic’s economic toll.

The Dallas bank set aside less in the second quarter for credit losses than analysts expected. Executives cited action in Texas and California to reverse reopenings and said they're still committed to the oil and gas business.

The company has established a fund that will provide capital, technical assistance and long-term recovery support to small businesses, especially minority-owned companies. The other megabanks are expected to donate their fees, also.

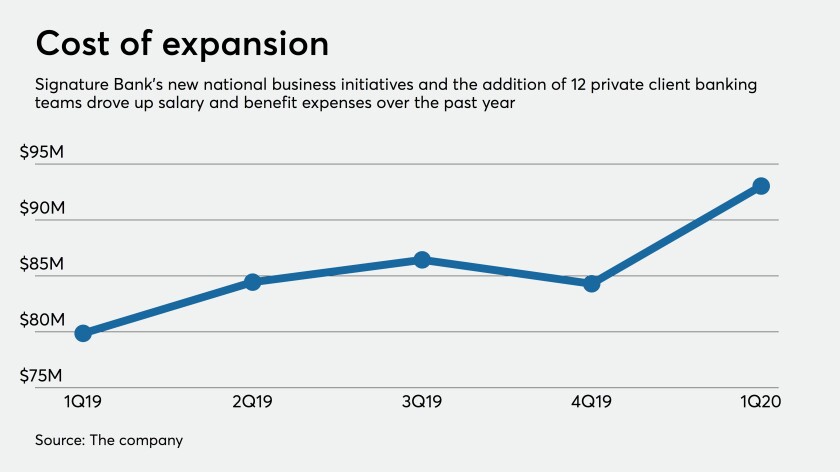

The New York commercial bank says geographic diversification is a long-term necessity and that the interplay of its private banking and commercial banking businesses has helped it withstand the economic shock of the coronavirus.

Consumers now have more control over their own financial decisions and loan options.

Federal Reserve Chairman Jerome Powell said about 300 lenders have signed on to the program and that the central bank is committed to making adjustments that could attract more borrowers.