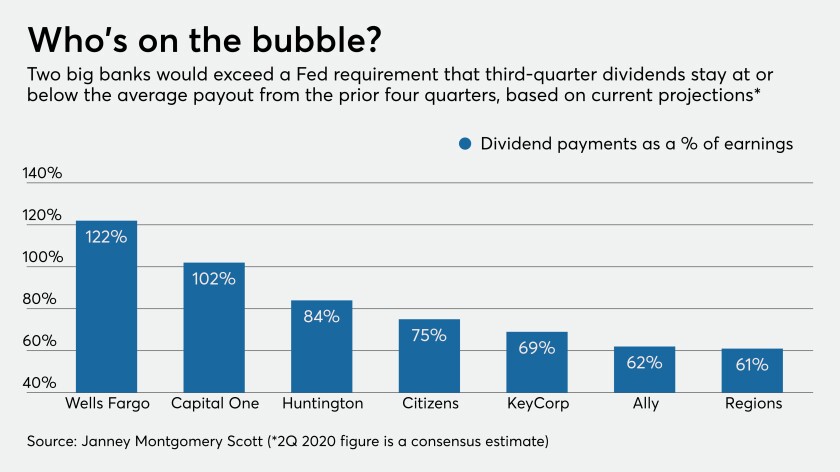

Some observers said the central bank should have suspended dividends entirely in response to an unprecedented economic emergency caused by the pandemic. Others said its more cautious moves were appropriate because big banks' capital is strong and the economy could bounce back.

Participation in the Main Street Lending Program for midsize companies is partly about public service, but the core business rationale is building "a banking relationship that continues on for some time," the Boston Fed chief says.

Business owners are changing banks at three times normal levels, a trend researchers attribute to their difficulty in obtaining emergency loans. If the forgiveness stage of the Paycheck Protection Program proves arduous, that rate could climb much higher.

Worried about a lack of demand and that some of their customers are ineligible, community banks are still on the fence about participating in the effort to back loans for businesses recovering from the pandemic crisis.

The online lender quickly built an app for ride-share drivers with much of their information already filled in.

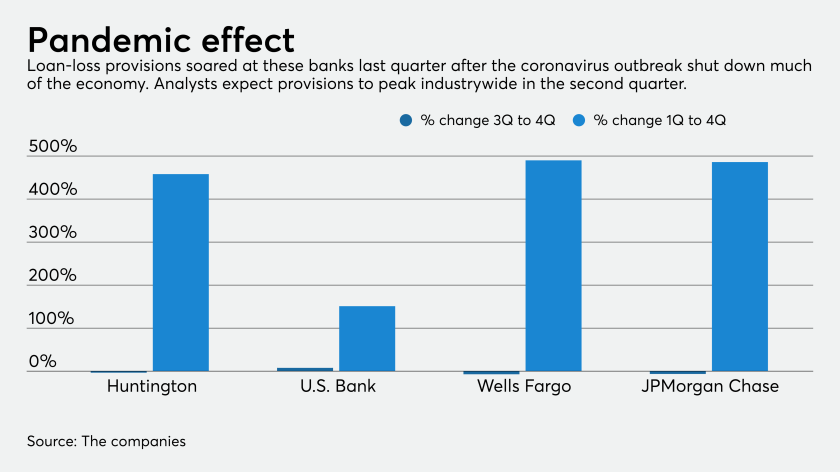

Lenders are cautioning not only that second-quarter provisions might exceed the spike seen earlier this year, but also that credit costs could be elevated into 2021 if the economic slowdown drags on or fears of a second coronavirus wave are borne out.

The global protests in the wake of George Floyd’s death should serve as a reminder that the banking industry must do more to support minority employees and customers.

The payroll provider has been partnering with accountants to help them secure loans for their small businesses.

Two years ago, the Tulsa, Okla., company expanded its Native American casino lending business nationwide. It seemed like a great plan until the coronavirus pandemic struck.

The changes being sought would benefit both small businesses and banks, which would avoid the cost of servicing many low-yielding loans.