- 9 Min Read

Current, Stoovo and other companies are reaching out with low-cost, low-fee financial services and even tools to help users search for part-time jobs.

6 Min ReadBusiness models and adaptability will determine the success — or failure — of financial technology companies as they deal with fallout from the coronavirus outbreak.

2 Min ReadConsumers now have more control over their own financial decisions and loan options.

5 Min ReadIn a new twist on an old scam, cybercriminals have tried to get thousands of people to surrender their Wells bank account information by sending authentic-looking emails containing malicious links that lead to a fake website bearing the company's name.

3 Min ReadThe online lender quickly built an app for ride-share drivers with much of their information already filled in.

8 Min ReadPeoples Bank in Arkansas and Main Street Bank in Massachusetts are getting smarter about spotting suspicious transactions tied to unemployment benefit fraud as well as warning customers what to watch out for.

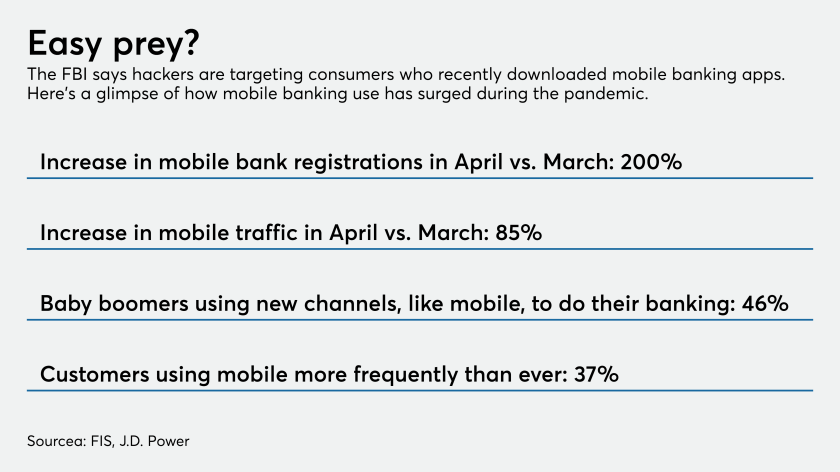

5 Min ReadMobile banking use has swelled since the pandemic hit, and law enforcement officials expect hackers to target the credentials of digital novices. The FBI stressed the importance of two-factor authentication and ensuring consumers know how to spot fake apps that carry malware.

6 Min ReadAfter initially processing the loans manually, the Minnesota bank turned to "low code" software to build the electronic forms and workflows needed to approve loan applications. The result: a more than fivefold increase in the number of loans it could process in a day.

3 Min ReadDigital banking has ramped up during the coronavirus lockdown but customers will seek somewhere to go as cities reopen. A branch could provide that safe haven.

5 Min ReadCustomers normally receive debit and credit cards inside a branch. Now banks are shifting the process to their drive-throughs and finding alternative ways for cardholders to key in their PINs.